`After researching for a while when I first came to the KYC2020 team, I realized that money laundering was a hugely complicated problem for countries and financial systems. I discovered that anti-money laundering compliance and vigilance is more of a frame of mind than a simple list of solutions. Compliance with money laundering regulations means implementing a program, having a process for ongoing improvement, and monitoring the program’s effectiveness over a period of time. This can be a daunting and distracting task for a small enterprise already struggling with access to resources. But the solution to AML compliance shouldn’t be so complicated that small and middle-sized enterprises (SMEs) are unable to keep up; and as a result of innovations in regulation technology (aka “RegTech”), it isn’t. Let’s look at some ways a small enterprise can stay AML compliant without the prohibitive cost and complexity.

With criminals adopting increasingly sophisticated means for money laundering, it has become harder for organizations and financial institutions to manage effective AML compliance programs. This is especially a problem for small businesses that lack the resources for implementing KYC (Know your customer) and CDD (Customer Due Diligence) processes at the customer and transaction level. Inefficient or inadequately resourced KYC and AML compliance programs impact the onboarding time for a new customer, resulting in lost customers or lost sales. SMEs are often left with two equally bad options:

- Non-compliance with KYC and AML procedures, or

- Risking the longer customer onboarding times (and hope for the best)

Of course, the real problem here is that AML compliance still relies to some extent on manual methods. Fortunately, we now have next-generation technology solutions powered by automated processes that can speed things up. They also help increase the accuracy and effectiveness of anti-money laundering procedures and reduce the overall cost of compliance. Let’s take a look at some of the latest AML compliance solutions available:

VisionIQ

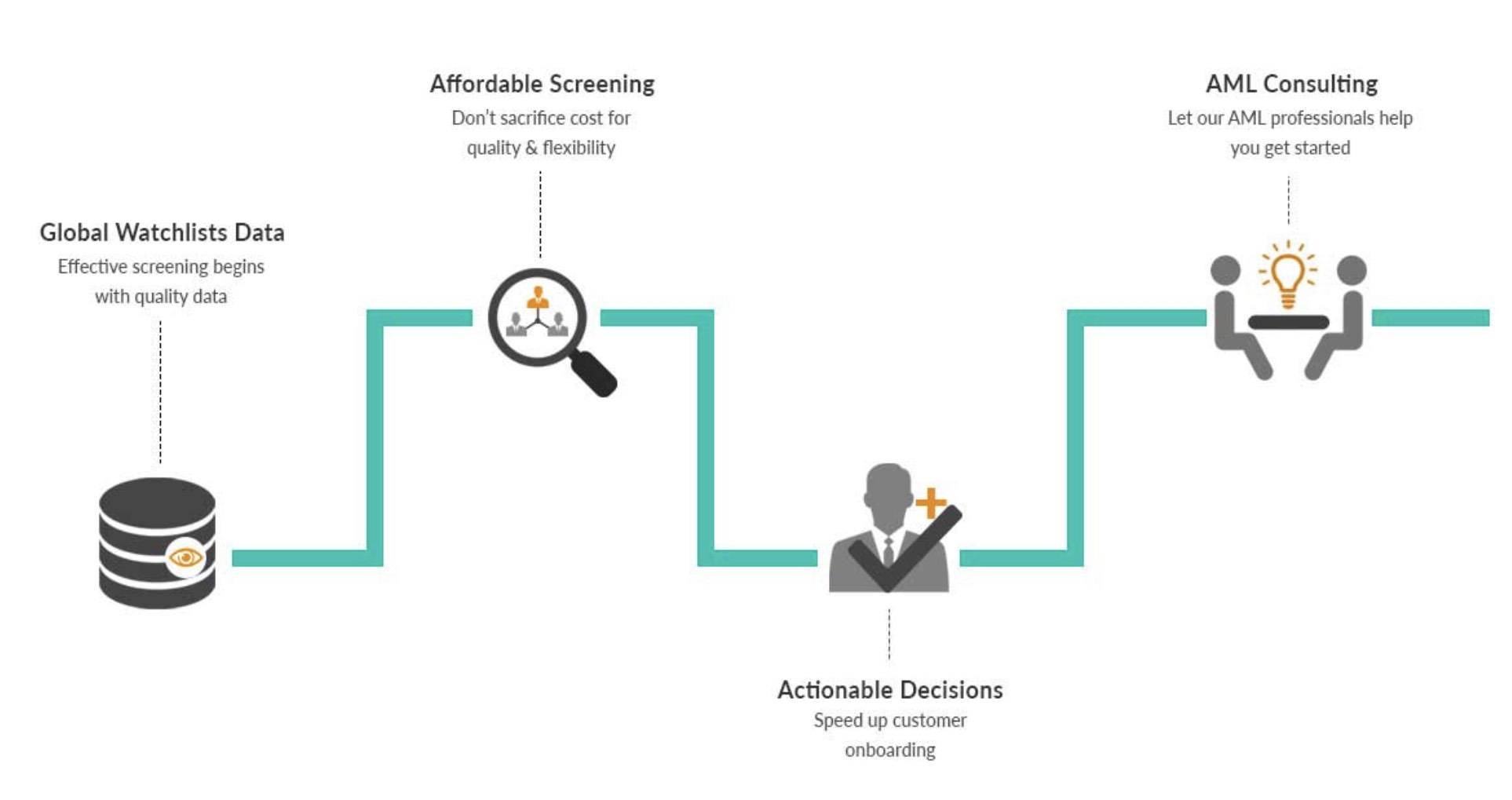

Much of AML compliance is reliant on the quality of the data you use. After all, screening data for potential threats won’t do much good if the data is incomplete or disorganized. This is where VisionIQ comes in. VisionIQ is a comprehensive and well-structured global watchlist database. We aggregate the data from a multitude of public sources, including sanction, terrorist, PEP, HIO, RCA, and criminal lists. The data is organized and structured for easy accessibility and screening. These lists are updated regularly to make sure that the data is as accurate as possible.

Quality of Data determines the effectiveness of your AML compliance program, and Cost of Data determines the affordability of the solution. This is what differentiates VisionIQ from the other data providers. It is the most comprehensive high quality source for global sanction and PEP, RCA, HIO and criminal data with the lowest cost price guarantee.

But good and affordable data is just the beginning of AML compliance. A comprehensive database is only as useful as the methods used to screen new and existing clients against the global watchlists.

SmartScan

SmartScan is a search engine tool that leverages KYC2020’s VisionIQ watchlist database to provide businesses with an easy to use, easy to implement intelligent search and scoring engine. The advantage with KYC2020, as a non-techy newbie like me can understand it, is that our system uses a pretty sophisticated search technology based on Apache Lucene, ElasticSearch™, that is combined with intelligent name matching algorithms and proprietary scoring methods to assure that you do not miss “True Positives” (i.e. catch the bad guy) while minimizing the need to manually clear “False Positives” (i.e. all similar sounding matches that result from fuzzy or phonetic searches).

I don’t claim to fully understand the technology, but I have come to clearly understand that 80% of the cost of sanction screening comes from the manual screening of false positives according to most reports. Reducing false positives means that SmartScan is able to drastically reduce the overall cost of sanction and PEP screening.

But many solutions in the marketplace claim the same sophistication and smarts to the point that they all sound alike. In fairness to my readers, I wanted to find the most comprehensive list of screening solutions providers so that you can do your research and make the right decision for your business. Turns out there is someone who is “watching the watchlists” and provides a rather comprehensive list of vendors. Here it is.

I am going to assume that most of the vendors and options listed by Mr. Watchlist are acceptable quality. But for most startups, virtual currency operators, and SMEs, quality options are only as meaningful as they are affordable! Afterall this has been the root of the problem – access to quality without compromising budgets.

I believe this is what differentiates KYC2020. Since KYC2020 owns both the data technology and the screening technology they can offer the most affordable payment plans without sacrificing quality or access to all of our features. Our own research on market pricing suggests that SmartScan is perhaps below 1/5th the cost of most enterprise solutions. Maybe you should do your own research and find out.

DecisionIQ

Unfortunately, even the most elegant of search engines will yield a certain percentage of false positives. This is to the tune of 2-7% and must be cleared by a compliance officer. With an industry average of 19 minutes to clear the false positive at $26/hr, the cost and time commitment becomes problematic for small enterprises quickly. And that’s not taking into account the friction and bad experience on the customer side as the false positive is processed. So how does this get solved? Well, for that you need to move from screening to rapid ‘decisioning’ with some level of AI and machine learning. A system that can accurately and speedily automate the detection and clearing process to render Pass/Fail screening decisions while keeping a complete and transparent track record of the decision-making process.

For that, DecisionIQ is our answer. It begins with an AML Risk-Assessment of our clients to determine what sanctions lists they need to screen along with search and scoring rules in order to be AML compliant. The DecisionIQ engine is then configured with that information in mind for decisioning. But DecisionIQ isn’t just about detection, clearing, and providing rapid Pass/Fail decisions. An important component of DecisionIQ design philosophy is providing fully transparent and auditable proof of decision. KYC2020 calls this a ‘Proof of Work’ file, and a ‘white-box’ system design approach to decision systems.

Finally, some SMEs want to completely outsource the compliance function. For that KYC2020 even offers the assistance of our Vskills™ certified AML officers in India to securely and cost-effectively outsource the review and audit process. No matter how our clients choose to handle their screening, whether in-house or outsource, quality and affordability are the linchpin of our business strategy. Want additional info about when to switch from sanction screening to sanction decisioning? You can find out more in our whitepaper.

To Sum It Up

Every responsible organization wants to make sure they comply with AML policies and procedures. This is easier said than done and among other factors, the cost of these processes may prevent businesses from acting in a responsible manner. If you’re facing similar problems with screening your clients, then we suggest you contact our team at KYC2020. We offer a wide range of AML compliance solutions that can help you out. Our AML compliance tools are guaranteed to be flexible, easy-to-use, and cost-friendly for your small enterprise.