AML Screening for Insurance Companies

Harnessing Real-Time Insights and Elevated Compliance for Insurance Operations

Revolutionize your AML Compliance with Real Time insights with KYC2020

Revolutionize your AML Compliance with Real Time insights with KYC2020

We bring solutions that will make it easier for Insurance Companies worldwide to comply with AML Regulations.

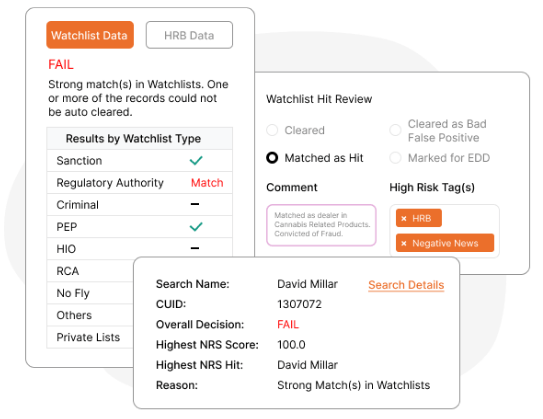

In the insurance industry, effectively managing policyholder risk is crucial. Our specialized AML software focuses on sanction, PEP, and adverse media screening and monitoring, ensuring compliance with regulatory requirements. By seamlessly integrating our solution, insurance companies can swiftly identify high-risk policyholders and assess potential exposure to financial crime. Our robust technology empowers insurance providers to proactively manage policyholder risk, enhancing overall compliance and safeguarding against illicit activities.

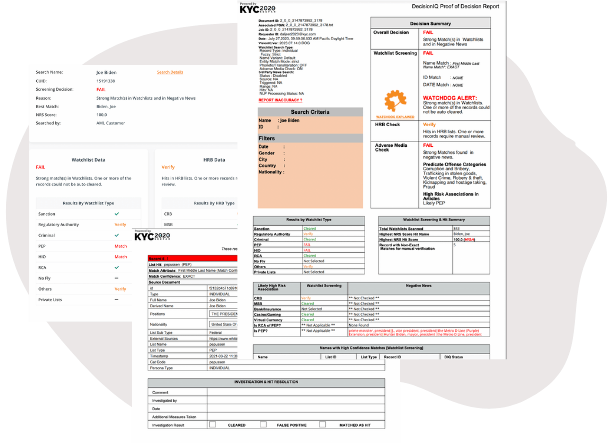

In today's stringent regulatory landscape, maintaining a clear audit trail is paramount. Our platform offers verifiable auditability, allowing financial institutions to trace and document every screening decision. From initial risk assessment to ongoing monitoring, our solution generates comprehensive and tamper-proof audit trails. This ensures transparency, accountability, and compliance with regulatory requirements. Gain peace of mind knowing that your institution's screening processes are fully documented and auditable, providing a solid foundation for risk management and regulatory reporting.

DecisionIQ comes with an intuitive user interface designed to optimize workflows for insurers, brokers, reinsurand underwriters. As your business scales, our adaptable interface ensures seamless integration and efficient utilization, enhancing your operational agility. Experience a user-friendly platform that empowers your team to navigate complex processes with ease, driving efficiency and confidence in your compliance practices.

Our state-of-the-art screening technology follows a streamlined 3-step process, swiftly identifying Sanctions, PEPs, and Adverse Media risks. With real-time data coverage and advanced algorithms, we ensure comprehensive compliance for your industry. Stay ahead of evolving regulations with confidence.

Watch the video to learn more about our screening technology

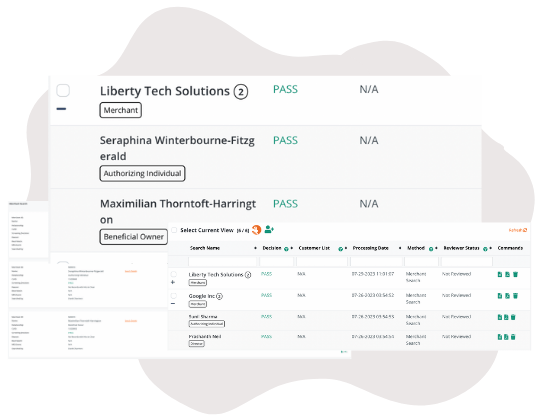

Streamline the onboarding process for insurance companies using our cutting-edge screening platform. Swiftly screen policyholders and assess potential risks, aligning with regulatory requirements. With our efficient solution, you can ensure compliance, minimize delays, and confidently expand your customer base while maintaining a robust AML framework.

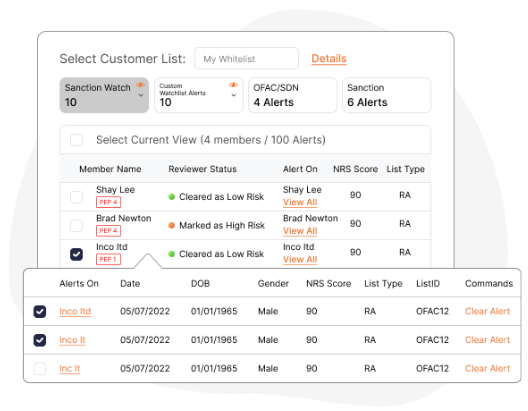

Simplify the process of handling alerts and potential risks with our efficient case management system. Insurance companies can seamlessly categorize, prioritize, and track cases through our intuitive interface. Collaborate with your team, escalate issues, and maintain a comprehensive audit trail, all while adhering to regulatory requirements. Our maker-checker functionality allows different users to have different access levels, ensuring a secure and controlled case review process. With KYC2020's robust case management, you can ensure swift and effective resolution, enhancing your overall risk mitigation strategy..

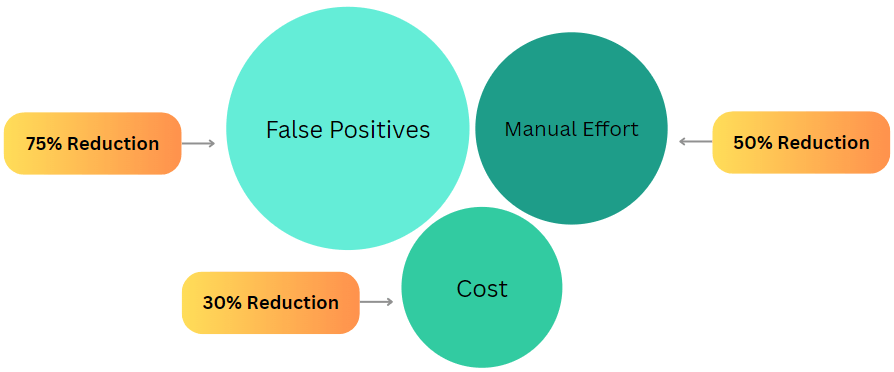

Experience the power of DecisionIQ's ongoing monitoring system, designed to eliminate false alerts for insurance companies. Our advanced technology ensures that you receive accurate and actionable alerts, enabling you to focus on genuine risks and enhance your policyholder due diligence. Stay compliant and confidently manage AML risks with zero distractions from false positives, empowering your insurance operations to run seamlessly.

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance