Keeping your business compliant when it comes to sanctions screening can be a bit intimidating. Let’s start with understanding what it means to Know Your Customer or Client (KYC). Banks must check the identity of their clients at the time of onboarding.…

The Newcomer

Your AML Compliance should not break the bank

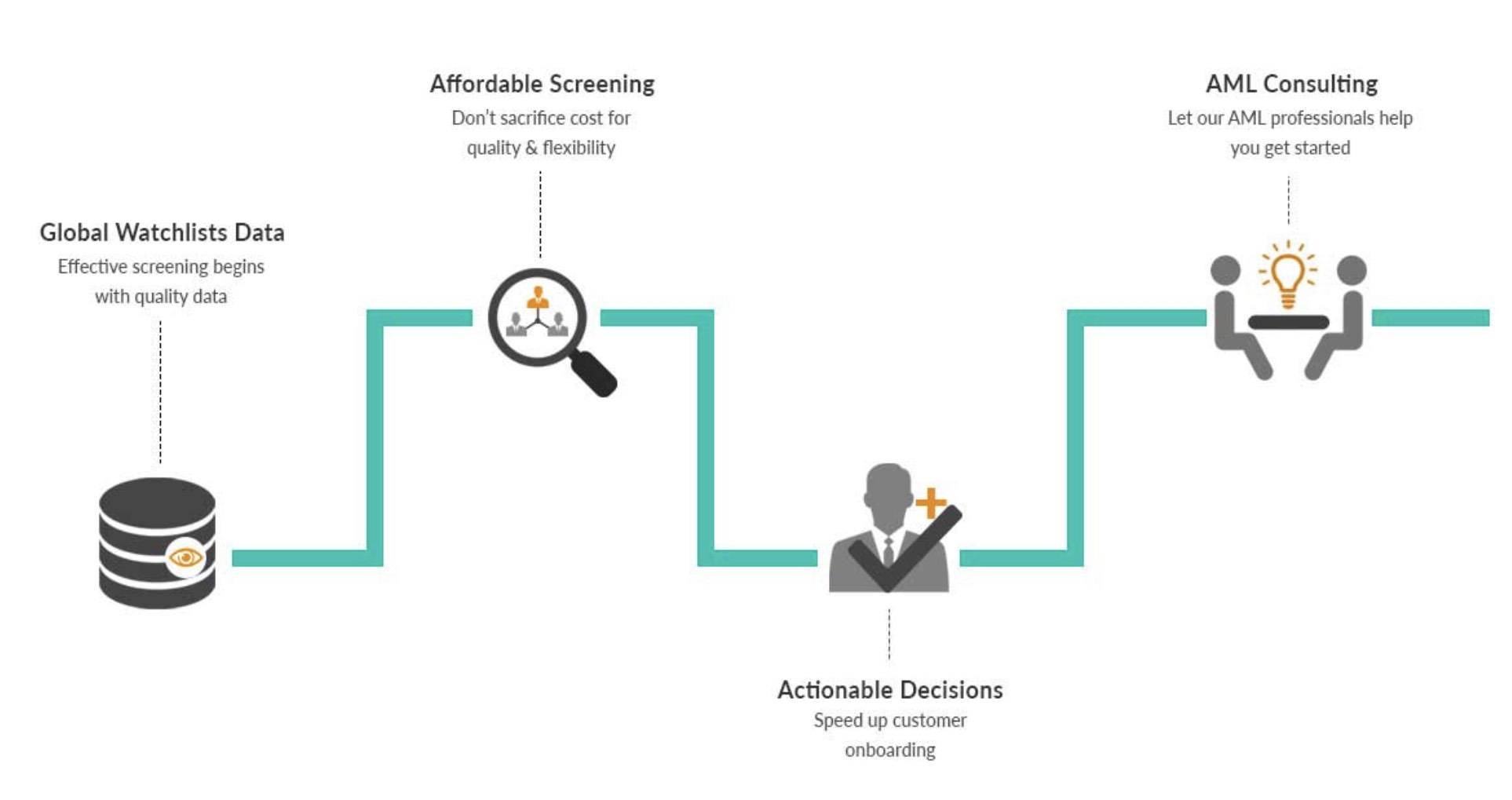

As your customers demand faster turnaround times, your business needs the best AML compliance process in place. For many small and medium-sized enterprises (SMEs), meeting quality sanction and PEP screening requirements are often unaffordable. SMEs try to get by with…

How AI helps your company fight Cyber Crime

Easy access to online payments, including money transfers, makes the need for sanction screening and AML compliance critical. Fines for AML/CFT non-compliance can be significant. For SME’s, credit unions, and Fintech companies, finding efficient and affordable solutions had been out…

Identifying “layering” in the fight against money laundering

Many criminal activities generate substantial volumes of cash that require money laundering and layering to avoid detection. These can include drug trafficking, arms dealing, terrorist activities, theft rings, and even human trafficking. The anti-money laundering regulations and controls are in place to…

Designating the Chief AML Compliance Officer

A classic Fintech startup has a tight budget making it difficult to hire a dedicated Chief AML Compliance Officer (CAMLO). This leads them to designating either a founder or other members in the organization to take on this role as…

The Various AML Compliance Agencies

Navigating the complexities of AML compliance is no easy task. Simply understanding the agencies that create regulations and enforce regulations can be challenging enough. This makes the task of maintaining AML compliance even more challenging especially when it comes to…

The Real Costs of AML Compliance

In 2018, LexisNexis found that the total costs of AML Compliance for financial firms in the United States is approximately $25.3 billion per year of operation. Compared to a firm’s bottom line, small businesses pay the most at upwards of…

The Newcomer’s Guide to Tools to Fight Money Laundering

`After researching for a while when I first came to the KYC2020 team, I realized that money laundering was a hugely complicated problem for countries and financial systems. I discovered that anti-money laundering compliance and vigilance is more of a…

The Newcomer’s Guide to The Essential Features of a Robust AML Compliance Program

In my research to better integrate into the KYC2020 team, I discovered that having an anti-money laundering program in place is a pre-requisite for all organizations these days. Money laundering has serious consequences attached to it and failing to implement…

The Newcomer’s Guide to The Consequences of Non-Compliance

I’ve been writing this Newcomer’s Guide to the AML Galaxy for a while now and I’ve written a line over and over again, “Failure to comply with AML regulations has serious consequences.” But I’ve never gotten into any specifics. Yes,…