AML Screening for Payment Providers

Upholding Trust and Security: Embracing AML Compliance in Payments

Empowering Seamless Transactions, Ensuring Financial Integrity

Empowering Seamless Transactions, Ensuring Financial Integrity

Empowering 300+ businesses with seamless AML compliance.

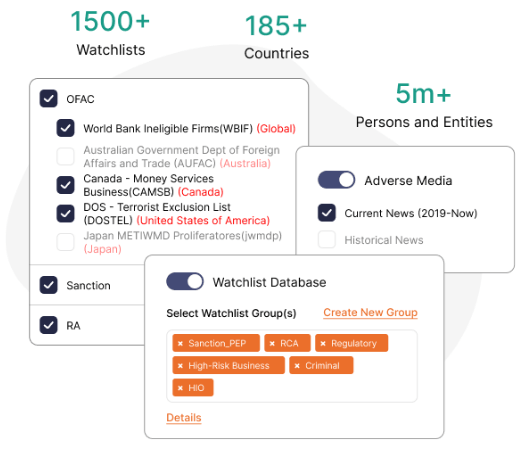

At KYC2020, we take data seriously. Our platform provides your business with real-time updates on sanctions, PEPs (Politically Exposed Persons), and Adverse Media data. Say goodbye to missed false positives and stay ahead of the curve with ever-changing regulations. With our robust data infrastructure, you can trust that your AML/KYC compliance process will be nothing short of seamless and precise.

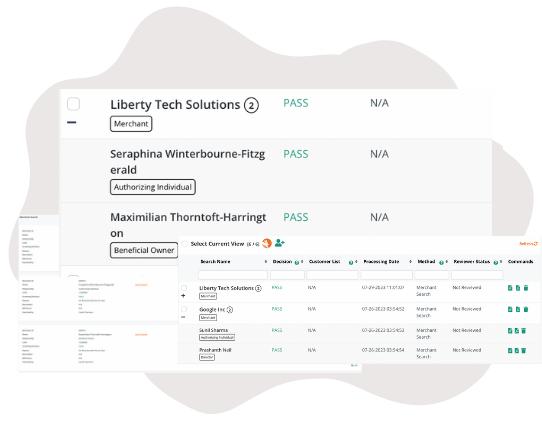

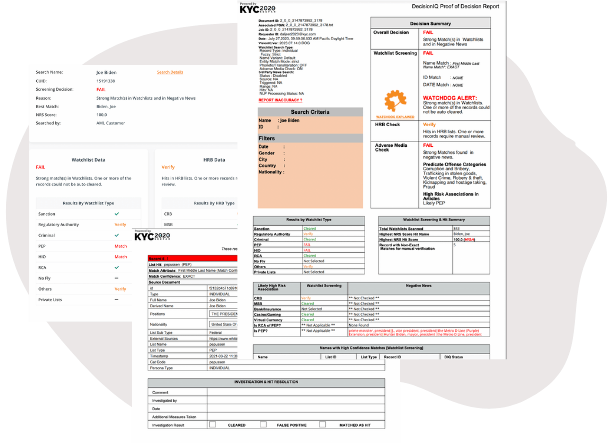

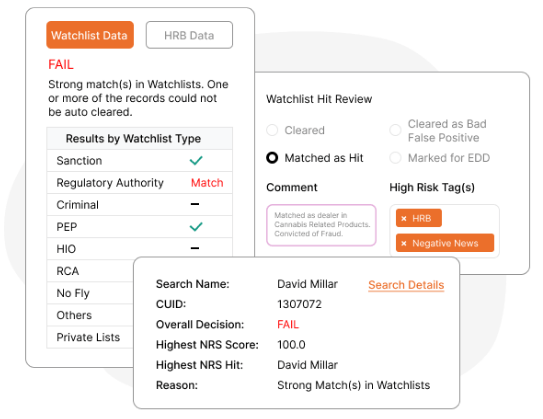

The latest release of DecisionIQ enables Payments companies to streamline searchability for businesses and beneficial owners. With the ability to group multiple names under a single ID, the process becomes seamless and efficient. Effortlessly manage and verify merchant information, ensuring compliance without compromising on speed or accuracy. Welcome your merchants with ease and confidence, knowing that our platform has got you covered every step of the way.

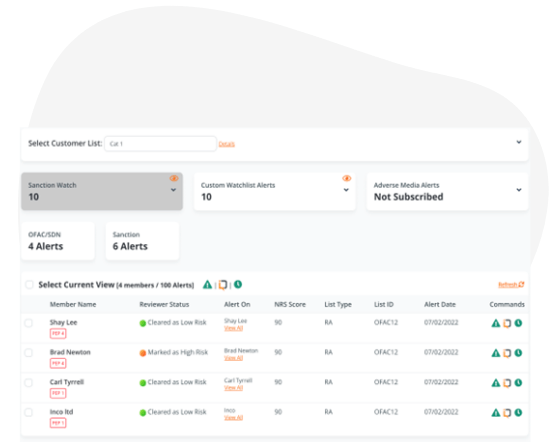

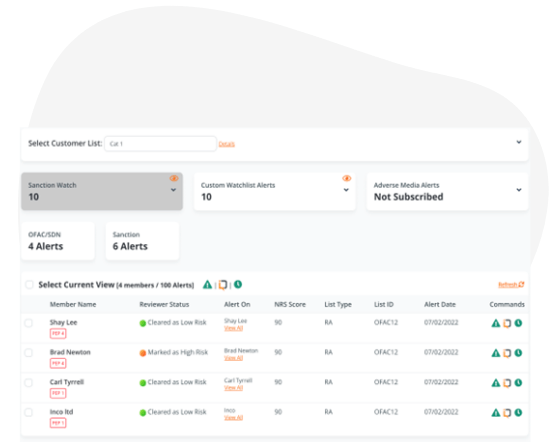

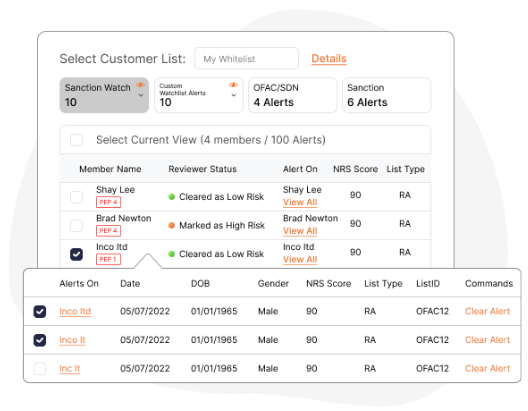

Stop dealing with false alerts from ineffective re-screening. DecisionIQ has built-in persistent monitoring. Create customer whitelists that are encrypted for data privacy and are continuously monitored against daily data changes. Get compliant and then stay compliant with ZERO false alerts.

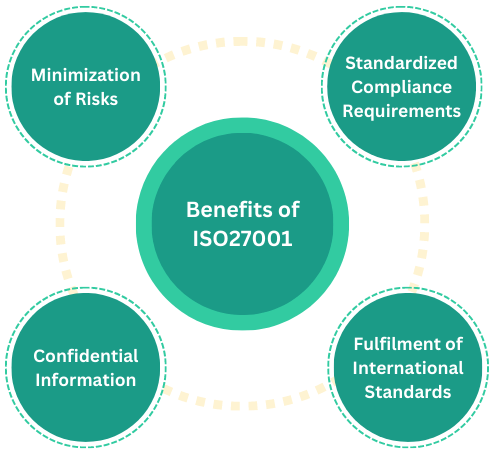

At KYC2020, we take data security seriously. Our ISO27001 certification for information security guarantees that your sensitive data is handled with the utmost care and protection.

Moreover, we've designed our solution to be fully GDPR compliant, ensuring that your data protection obligations are met with the highest standards.

We understand that speed is essential for Payment Providers. With our seamless integration capabilities, you can effortlessly integrate our API with your existing systems. This automation simplifies onboarding processes and enhances workflows, making compliance tasks efficient and streamlined.

KYC2020 offers full audit trail transparency, recording every step of compliance processes in real-time. With detailed logs and timestamps, our solution empowers businesses to demonstrate due diligence, ensure AML/KYC compliance, and easily identify and address potential issues. Trust our platform to enhance your compliance posture and build confidence with regulators and customers alike.

As a payment provider, adhering to Financial Action Task Force (FATF) guidelines is crucial. KYC2020's DecisionIQ ensures robust AML screening, sanction checks, and PEP identification, enabling you to meet FATF's stringent requirements. Our AI-powered platform empowers your payment processes with real-time data coverage and risk-based monitoring, ensuring airtight compliance and bolstering your reputation.

Use the latest sciences in information processing and human factors engineering to improve case review speed and productivity at scale. Features include pattern-based filters, information centralization, bulk clearing and annotation, segregated user roles and more.

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance