Did you know that despite the market capitalization of cryptocurrency peaking at $3 trillion it continues to surpass over $1 billion daily? With such volatility, growth, and potential, money laundering and terrorist financing mirror the same risks as the traditional…

KYC

Precision Matters: Best Practices and Challenges in Arabic Language Screening for AML

In the Middle East, within a thriving start-up ecosystem that has recently an impressive 1.6 billion USD in funding for MENA start-ups this year, Anti-Money Laundering (AML) compliance is of paramount importance. One of the distinctive challenges in this region…

Adverse Media Screening: How Do You Get It Right?

As adverse media screening (AMS) gets harder to do, setting your AMS system up right has never been more critical to your organization’s reputation, compliance, and workflow. It’s dammed if you do. Dammed if you don’t.

What does it mean to Know Your Customer?

Keeping your business compliant when it comes to sanctions screening can be a bit intimidating. Let’s start with understanding what it means to Know Your Customer or Client (KYC). Banks must check the identity of their clients at the time of onboarding.…

The Real Costs of AML Compliance

In 2018, LexisNexis found that the total costs of AML Compliance for financial firms in the United States is approximately $25.3 billion per year of operation. Compared to a firm’s bottom line, small businesses pay the most at upwards of…

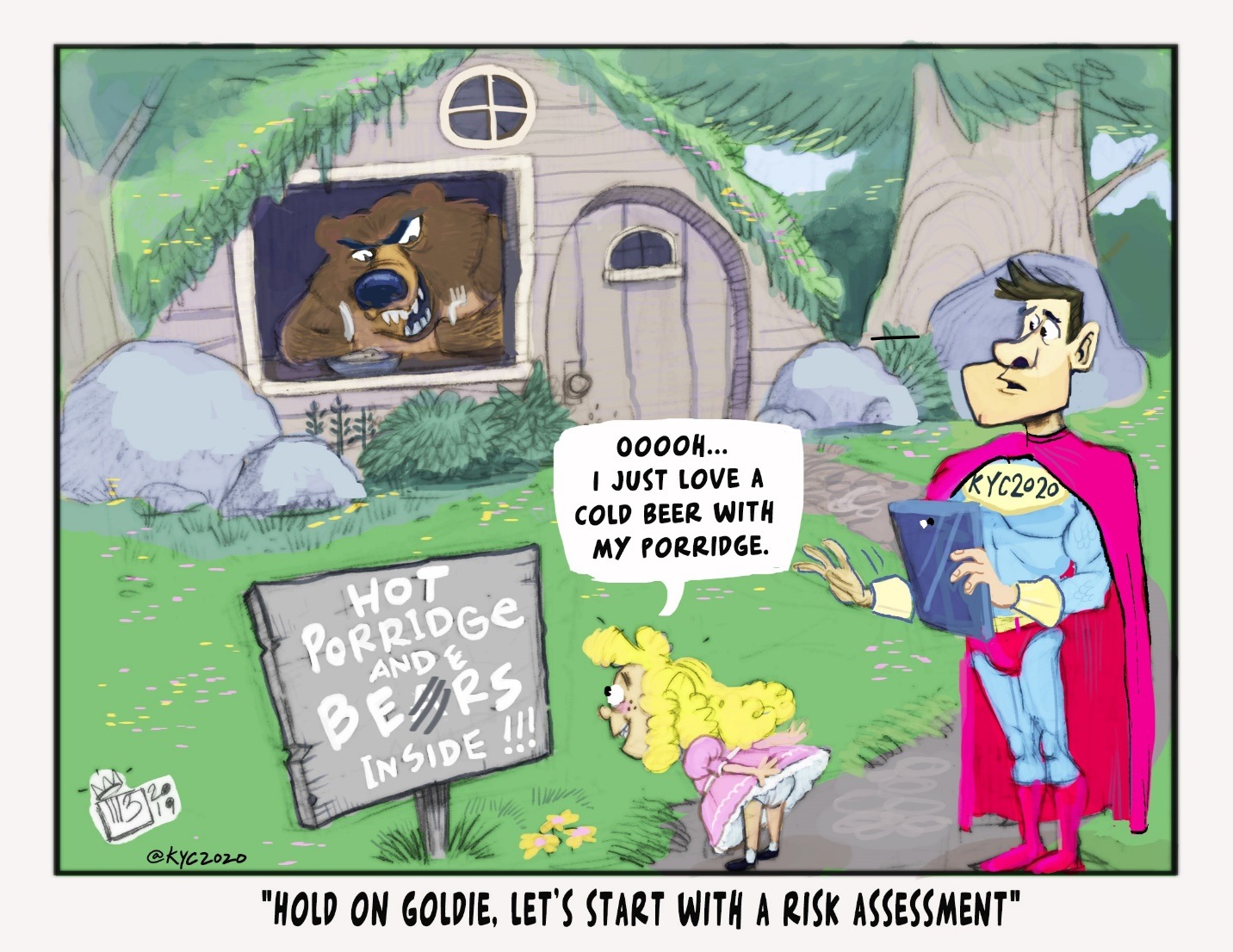

Introducing Our Free AML Risk Assessment Tool

Any business that deals in money and financial assets should start with a Risk Assessment for Money Laundering, Human Trafficking, and Terrorism funding. This includes firms that deal in cryptocurrency, payments, remittances, real estate, and other high-value commodities. AML Risk…

AML Risk Assessments are an Eye Opener

As part of any AML compliance regime, the first step is to do an assessment of the risk associated with the business according to regulatory requirements. The Risk Assessment, or RA, takes into account a large scope of the business…

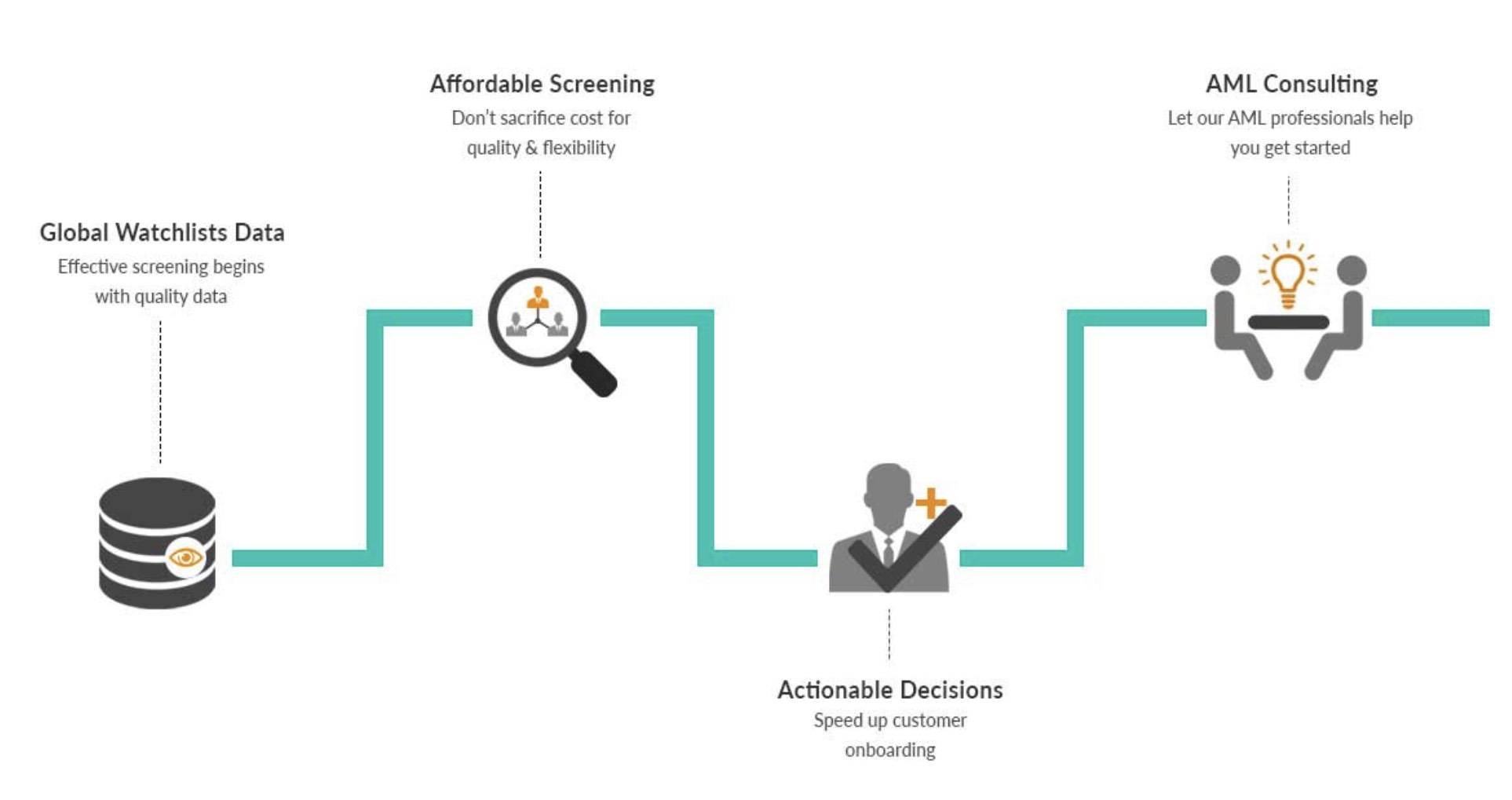

The Newcomer’s Guide to Tools to Fight Money Laundering

`After researching for a while when I first came to the KYC2020 team, I realized that money laundering was a hugely complicated problem for countries and financial systems. I discovered that anti-money laundering compliance and vigilance is more of a…

The Newcomer’s Guide to The Essential Features of a Robust AML Compliance Program

In my research to better integrate into the KYC2020 team, I discovered that having an anti-money laundering program in place is a pre-requisite for all organizations these days. Money laundering has serious consequences attached to it and failing to implement…

The Newcomer’s Guide to Protecting Your Small Business from Money Laundering

When I was hired on to help KYC2020 with their marketing strategy, I was completely new to the concept of AML complaince solutions. I never thought seriously about the threat of money laundering. Nor had I thought about what steps…