HOW TO ACCESS OUR DATA

All 37 FATF member countries & 180+ observing members

All 37 FATF member countries & 180+ observing members

All 37 FATF member countries & 180+ observing members

Over 198 countries at the Federal level plus RCAs

All as mandated by FATF including HIO

Cannabis Related Businesses, MSBs, Casinos, & more

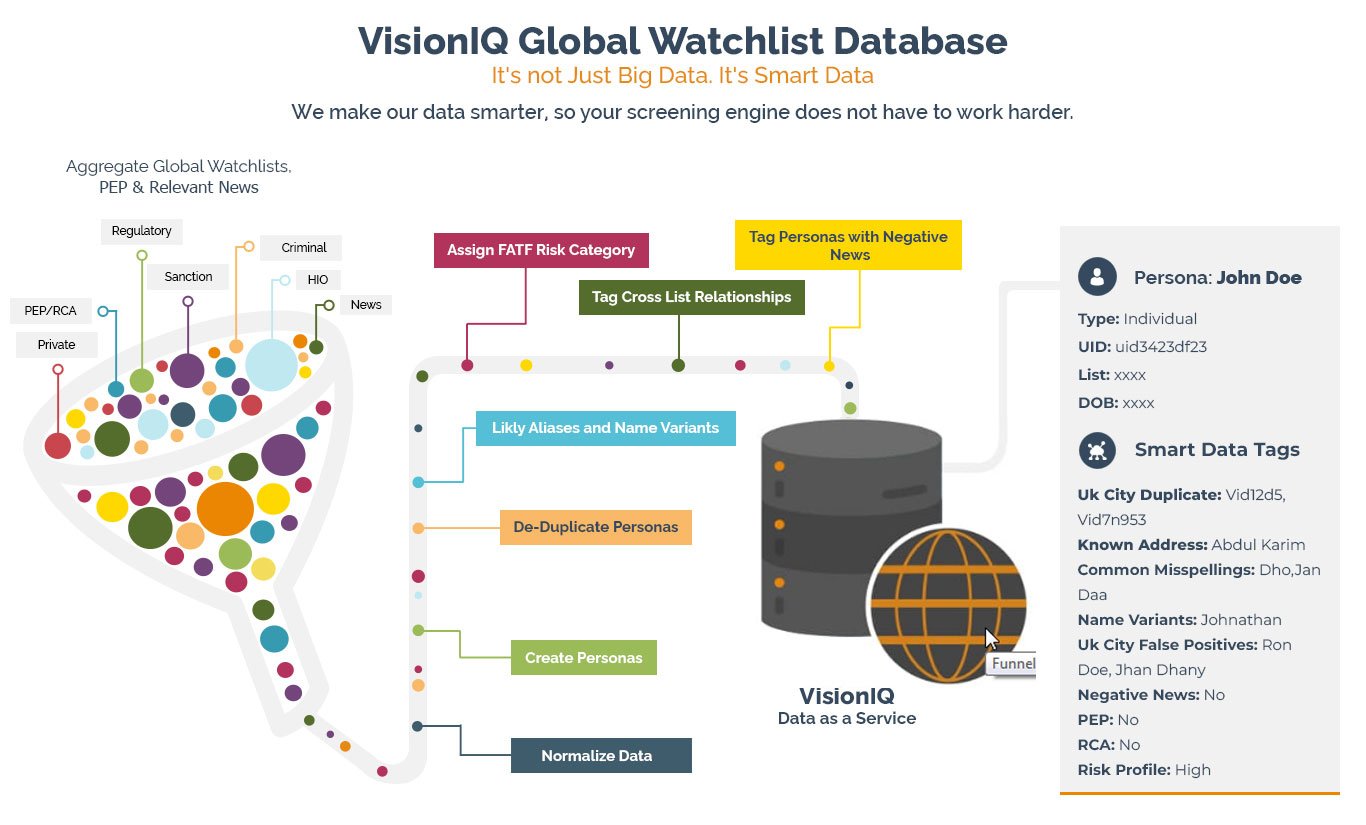

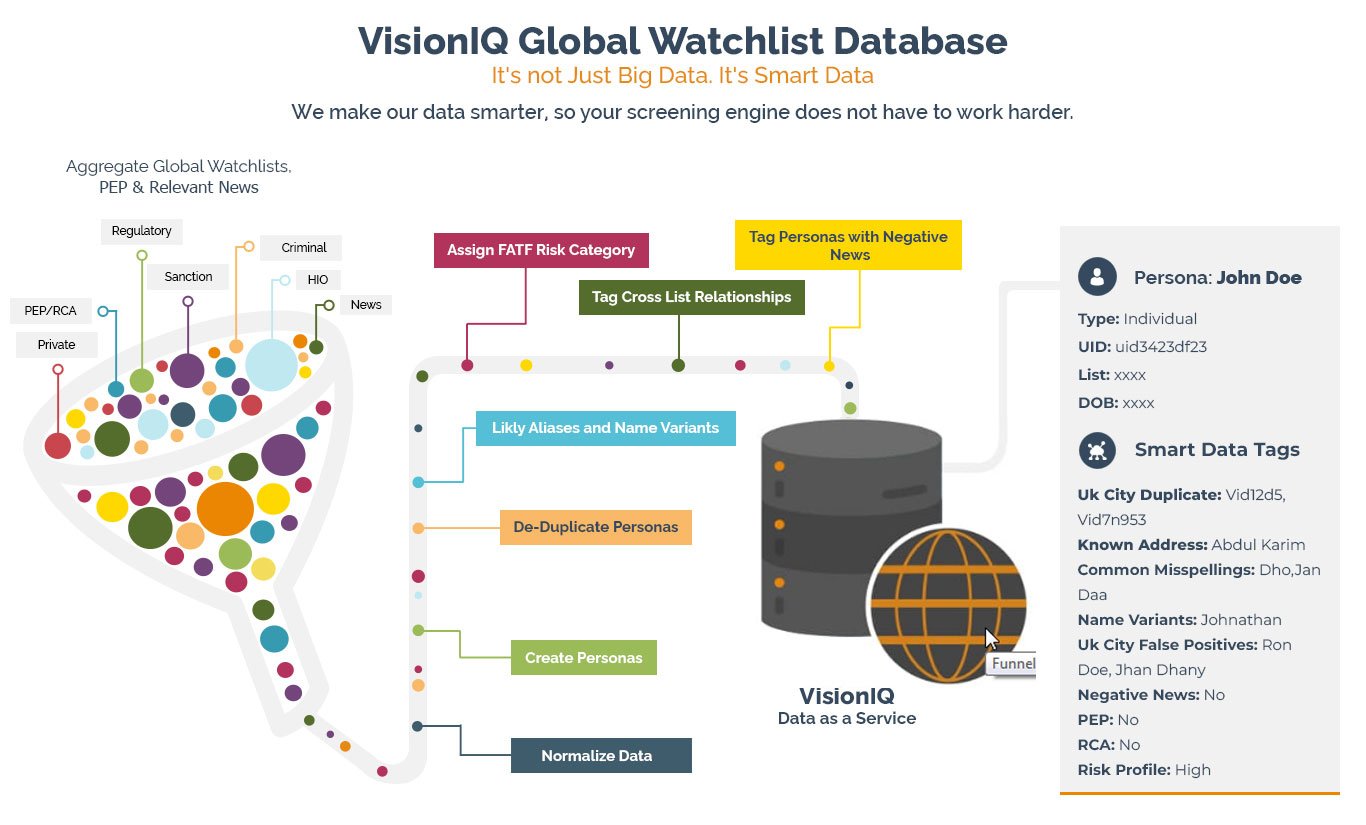

Most AML compliance data vendors build and promote BIG DATA. Problem with big data often is garbage in, garbage out! This leaves you with over-engineering your screening systems to make sense out of garbage data, and still dealing with excessing false positives or missing true positives. Our approach to AML/CFT compliance data is different— Comprehensive yet Smart! Whether you are a credit union with limited screening requirements, or a financial institution that banks high risk customers, we have the data for you.

Aggregated for regulatory, sanction, OFAC, HIO, criminal, terrorist, PEP, RCA and more.

AI/ML filters identify relevant and contextual adverse media personas per FATF risk profiles.

Lists are regularly updated using bots. Our humans are busy adding new sources.

Data files are available for access as CSV, JSON, or via API for easy download.

A persona database is created that is easy to index by name for fast and reliable screening.

Cross-list relationships are mapped across sanction, OFAC, PEP, and adverse media datasets.

Personas are tagged with aliases, common name variants and misspellings to reduce fuzzy search errors.

Personas are tagged with common and recurring false positives to make the data smarter.

This includes Regulatory Authority watchlists for illegal MSBs, Registered Casinos, CRBs+ and our Adverse Media Database with Persons and Entities associated with high risk business or activity.

We cover all 37 FATF member countries and most of the 180+ observing members.

Criminal lists such as RCMP, FBI, Interpol are available as well as Miscellaneous lists such No-Fly, Sex Offenders, etc.

These lists are based on the publically available data on politicians around the world. KYC2020 now includes over 198 countries at the Federal level.

The FATF has mandated that heads of international organizations be identified as potential for corruption in a similar way PEPs are today.

Relevant news sources are screened for persons and entities with negative news related to financial crime.

FATF Lists - by organizations and countries

These lists are the baseline for any KYC list screening tool. KYC2020 has the vast majority of these and include the 37 member countries and organizations which are part of the FATF. Many of the 180+ observing member’s lists are also available and more will become available over time.

PEP Lists – Federal, State, and Municipal

These lists are based on the publically available data on politicians around the world. KYC2020 now includes over 198 countries at the Federal level. In addition, as governments adopt a more “open” policy for providing this information in a structured format,it will be available on the list screening tool sooner.

Adverse Media News Sources

We screen relevant global news sources multiple times during the day for negative sentiment, context, and relevancy to financial crime.

Organizational Lists – Heads of International Organizations, Directors, and Major Shareholder

The FATF has mandated that heads of international organizations be identified as potential for corruption in a similar way PEPs are today. They have gone further and stated that directors and major shareholders be identified and screened as well. Not to say that these persons are corrupt, just that the compliance officer be aware that the individual is acting on behalf of an inter-governmental organization or major corporation, and act accordingly as part of their AML regime. These lists are vast and many are publically available at most stock exchanges, and government related corporation sites.

Enforcement Lists

Most, if not all, FATF members have a list of enforcement actions taken against an individual and/or entity in their jurisdiction. KYC2020 has implemented most of these, and as other members make their lists public, they will be added to ensure that the most up to date lists are available for KYC list screening.

Criminal and Miscellaneous Lists

Criminal lists such as RCMP, FBI, Interpol are available as well as Miscellaneous lists such No-Fly, Sex Offenders, etc.

High Risk Business Lists

FINCEN lists several factors to consider when categorizing an entity as a high-risk business (HRB). These include MSBs, Casinos, and Online Gaming.

Our HRB Lists include Regulated Authority watchlists for illegal Money Service Businesses (MSBs), public lists for registered casinos and online gaming businesses, state and provincial licensing data in USA and Canada for Cannabis Related Businesses (CRBs)+ and MSBs, and our Adverse Media database for persons and businesses with negative news associations to a high risk business or activity.