AML Screening for Crypto Companies

Empowering Crypto Business Growth: AML Compliance and User-Friendly Solutions

Simplify Compliance, Amplify Growth, and Thrive in the Crypto World!

Simplify Compliance, Amplify Growth, and Thrive in the Crypto World!

We bring solutions that will make it easier for Banks & Neobanks to comply with AML Regulations.

Complying with the Fifth Anti-Money Laundering Directive (5AMLD) is made easy with our product. Our platform streamlines cryptocurrency and prepaid card compliance, ensuring effective due diligence measures. With automated Sanction & PEP screening and advanced risk assessments, your business stays ahead of AML regulations.

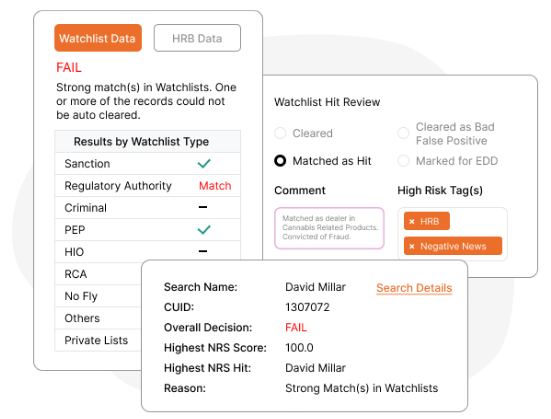

Experience seamless Sanction screening, PEP screening, and Adverse Media screening with KYC2020. Our AI-powered platform provides instant results, ensuring swift and accurate decision-making to identify high-risk individuals and entities. Stay compliant and mitigate financial risks with our efficient screening solutions, trusted by leading businesses worldwide.

Watch the video to learn more about our screening technology

KYC2020 is a leading provider of sanction screening solutions that align with the Financial Action Task Force (FATF) recommendations for Virtual Asset Service Providers (VASPs). Our highly configurable and reliable software ensures VASPs can seamlessly integrate our solution into their existing systems, streamlining onboarding processes and enhancing AML compliance workflows.

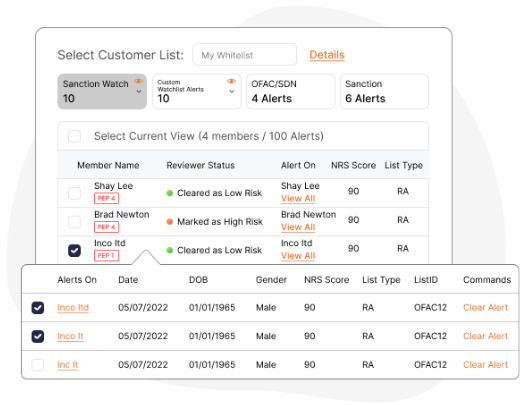

Embracing AML compliance doesn't have to be overwhelming. Our people-friendly workflow simplifies regulatory adherence for your crypto business. With intuitive design and visualizations, our platform empowers your team to navigate complex compliance processes effortlessly. Partner with us to create a seamless and compliant future.

With DecisionIQ's built-in persistent monitoring you can create customer whitelists that are encrypted for data privacy and are continuously monitored against daily data changes on OFAC/SDN and Global Sanction lists. Get compliant and then stay compliant with ZERO false alerts.

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance