AML Screening for Lending Institutions

Robust Watchlist Screening for Informed Lending Decisions

Revolutionize AML Compliance with Real Time screening decisions from KYC2020

Revolutionize AML Compliance with Real Time screening decisions from KYC2020

We bring solutions that will make it easier for lenders to comply with AML Regulations.

KYC2020 AI-Driven AML software empowers credit unions, lenders, and financing platforms to identify potential financial crime risk in customers as they occur, allowing proactive detection and immediate action against suspicious activities.

By automating the collection, verification, and analysis of customer data, the software ensures a seamless and efficient onboarding experience while maintaining compliance with AML regulations. This automation saves time and resources, enabling institutions to focus on providing exceptional lending services.

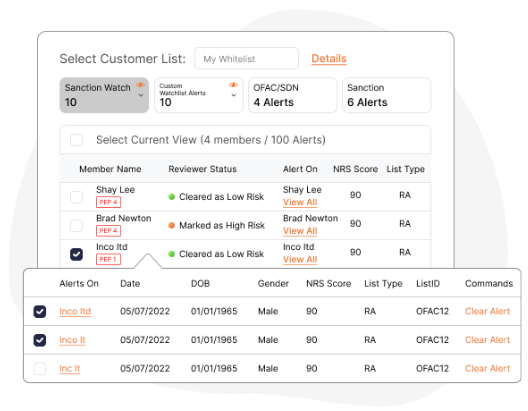

Say goodbye to ineffective re-screening alerts. DecisionIQ offers persistent monitoring. Establish encrypted customer whitelists, under constant scrutiny for changes. Attain and uphold compliance with ZERO false alerts. Receive email and UI alerts for customer status changes. Schedule ongoing monitoring in line with your risk-based approach

Our advanced solution equips credit unions, lenders, and lending firms with critical customer data. Real-time access to OFAC/SDN and global sanction lists enables institutions to make confident lending decisions while minimizing potential risks and ensuring strict compliance with AML regulations. Revolutionize your underwriting process with our cutting-edge software.

With the continuous growth of customer base in credit unions, lenders, and lending firms, the risk of potential financial crime escalates. KYC2020 provides scalable solutions to keep pace with customer expansion, ensuring effective risk mitigation and bolstering compliance efforts as the institution expands its lending services.

DecisionIQ enables lending companies to uphold stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) standards. Streamline onboarding, enhance risk assessment accuracy, and fortify your defence against financial crime. With KYC2020, your lending operations can confidently navigate the regulatory landscape while providing secure and transparent financial services

Utilize DecisionIQ's RESTful API to seamlessly integrate loan request processes via APIs. This integration facilitates faster and more secure loan applications, simplifying the user experience for borrowers and ensuring compliance with AML regulations behind the scenes.

Combining AI and human intelligence, we process data in real-time, reducing onboarding time significantly. Our WatchDog auto-clears false positives, while handling high-risk and edge cases efficiently. Maintain a top-notch compliance program without compromising onboarding speed.

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

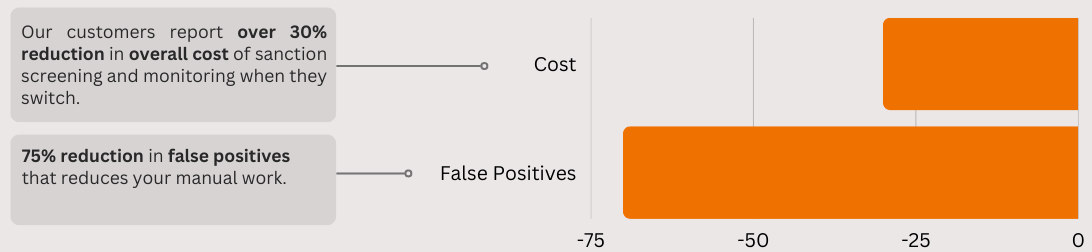

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance