AML Screening for Banks and Neobanks

Reimagining AML Compliance for Unrivaled Security and Streamlined Adherence

Empower Your AML Journey by exploring Expert Solutions for Compliance and Security.

Empower Your AML Journey by exploring Expert Solutions for Compliance and Security.

We bring solutions that will make it easier for Banks & Neobanks to comply with AML Regulations.

Our AML compliance software automates processes, allowing banks and neobanks to scale operations efficiently. Real-time monitoring identifies risks promptly, while dynamic updates ensure ongoing compliance. With automation, banks and neobanks can handle higher onboarding volumes and exceed AML regulations.

KYC2020's Adverse Media Check® is an AI-based service that monitors global news sources, creating a database of individuals, companies, and PEPs with negative news related to financial crimes. Say goodbye to slow onboarding and false positives, as our advanced algorithms identify associations, sentiment, and more. Enhance your firm's reputation with our state-of-the-art solution.

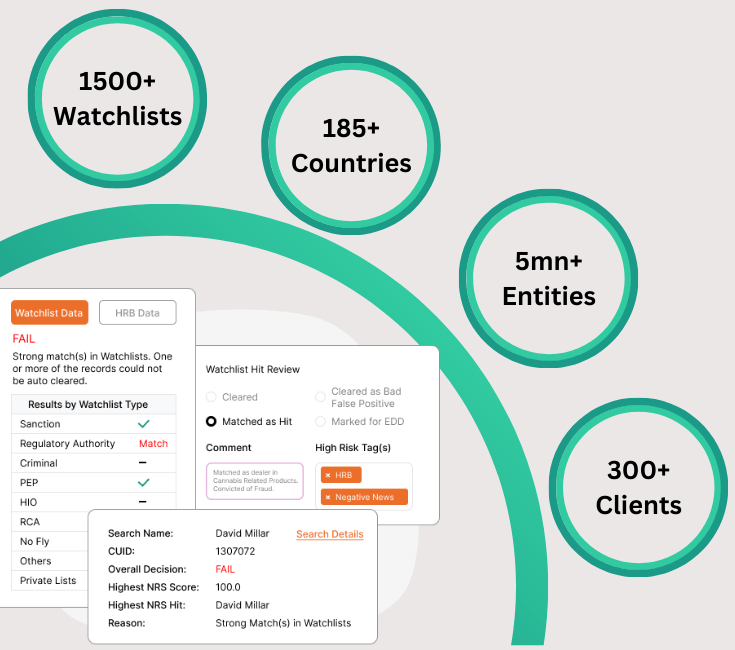

Experience seamless Sanction screening, PEP screening, and Adverse Media screening with KYC2020. Our AI-powered platform provides real-time results, ensuring swift and accurate decision-making to identify high-risk individuals and entities. Stay compliant and mitigate financial risks with our efficient screening solutions, trusted by leading businesses worldwide.

Watch the video to learn more about our screening technology

Banks and neobanks require a dynamic risk-based strategy for compliance. DecisionIQ by KYC2020 offers an intelligent solution that adapts to your institution's risk appetite. Our platform automates customer due diligence, sanctions screening, and PEP checks, streamlining onboarding and monitoring. By focusing resources where risks are highest, you achieve regulatory compliance efficiently while minimizing false positives and enhancing customer experience.

We understand that speed is essential for Banks and Neobanks. With our seamless integration capabilities, you can effortlessly integrate our API with your existing systems. This automation simplifies onboarding processes and enhances workflows, making compliance tasks efficient and streamlined.

As per the Financial Action Task Force (FATF) guidelines, banks must implement robust anti-money laundering (AML) and counter-terrorism financing (CTF) measures. DecisionIQ from KYC2020 ensures banks meet these requirements seamlessly. Our platform offers real-time sanctions screening, PEP checks, and adverse media monitoring. By adhering to FATF recommendations, banks can confidently prevent illicit financial activities, reduce risks, and uphold global AML standards.

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance