In the Middle East, within a thriving start-up ecosystem that has recently an impressive 1.6 billion USD in funding for MENA start-ups this year, Anti-Money Laundering (AML) compliance is of paramount importance.

One of the distinctive challenges in this region is the complexity of name screening in Arabic script. Transliterating Arabic names into Latin characters presents specific challenges with significant implications for AML compliance.

This blog delves into the world of AML compliance in the Middle East, discussing the challenges of transliterating Arabic names, navigating the regulatory landscape, and highlighting the key authorities shaping AML requirements in the region. We’ll also emphasize the critical role of precision in AML compliance, particularly when it comes to Arabic language screening.

Understanding AML Regulations in MENA

Significance of the Middle East

MENA covers 6% of the world’s population and contributes to 4.5% of the global economy through 21 diverse countries, it holds a complex regulatory landscape for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF).

Some of the key regulators are:

UAE – CBUAE

The Central Bank of the UAE (CBUAE) is the central financial regulator. It oversees, develops, and maintains the UAE’s financial system. The Regulatory Development Division within its Banking and Insurance Supervision Department sets AML/CFT policies.

Qatar – QFCRA

Qatar’s financial sector is regulated by the Qatar Financial Centre Regulatory Authority (QFCRA). Established in 2002, it authorizes and regulates financial services, with a dedicated AML/CFT unit. The QFCRA also actively engages with international standard-setting bodies.

Saudi Arabia – Ministry of Anti-Money Laundering, SAFIU & SAMA

Saudi Arabia takes a coordinated approach to tackle money laundering. The Ministry of Anti-Money Laundering, the Saudi Arabian Monetary Agency (SAMA), and the Saudi Arabian Financial Intelligence Unit (SAFIU). The Permanent Committee for Anti-Money Laundering, coordinates AML efforts at the SAMA head office in Riyadh.

Oman – CBO & CMA

Oman has two primary regulatory authorities. The Central Bank of Oman (CBO) oversees and licenses financial institutions, implementing AML/CFT regulations. The Capital Markets Authority (CMA) supervises Oman’s capital market and insurance sectors.

Egypt – Egyptian FIU

Egypt’s AML/CFT landscape is managed by the Egyptian Financial Intelligence Unit (FIU). It analyzes suspicious transaction reports and ensures compliance. Egypt also commits to combating financial crimes through the National Committee for Combating Money Laundering and Terrorism Financing (NCMLTF).

Jordan – Central Bank of Jordan

The Central Bank of Jordan leads AML/CFT efforts. It regulates and supervises financial institutions, participating in international initiatives against financial crimes.

Lebanon – BDL

Lebanon’s Banque du Liban (BDL) is responsible for AML/CFT oversight, ensuring the stability and integrity of Lebanon’s financial system.

Comprehensive AML Requirements

AML requirements in the Middle East align with international standards, the MENAFATF adopts and implements the FATF 40 Recommendations in the region in a way that does not conflict with the cultural values, constitutional frameworks and legal systems in the member countries. They encompass key areas like Customer Due Diligence (CDD), Transaction Monitoring, Suspicious Activity Reporting, Record Keeping, Employee Training, PEP and Adverse Media screening, Sanctions Compliance, and a risk-based approach.

The Challenges of Arabic Language Screening for AML

In the multifaceted Middle East and North Africa region, where ancient civilizations meet modern finance, an intriguing challenge emerges for Anti-Money Laundering (AML) screening: the diversity of scripts. Regulatory bodies often maintain watchlists with names in Latin scripts, while Middle Eastern banks may have names recorded in Arabic script. This linguistic divergence poses unique challenges for AML screening providers.

Transliteration Complexities

Transliterating Arabic names into Latin script becomes imperative due to the distinctive Arabic script, which features sounds markedly different from English. Currently, there’s no universally accepted standard for this transliteration, leading to variations in spelling that screening providers must navigate. Let’s delve into some transliteration scenarios:

- The Elusive “ق”: Arabic’s “ق” represents a unique “k”-sound, pronounced deep in the throat. In Latin script, it’s typically transliterated as either “k” or “q,” adding a layer of ambiguity.

- The Enigmatic ‘ayin: Arabic’s ‘ayin, represented by the letter ع, introduces another challenge. The sound often gets marked with an apostrophe or omitted in English transliterations, generating diverse spellings.

- Pronunciation vs. Script: Arabic names occasionally defy their written forms. This discrepancy results in multiple Latin transliterations, further compounded by the presence or absence of hyphens.

- Dialectal Variations: Arabic’s letter “ج” is pronounced differently in Egypt (“g” as in “good”) and elsewhere in the Middle East (“j” as in “jungle”). This linguistic diversity necessitates multiple spelling choices.

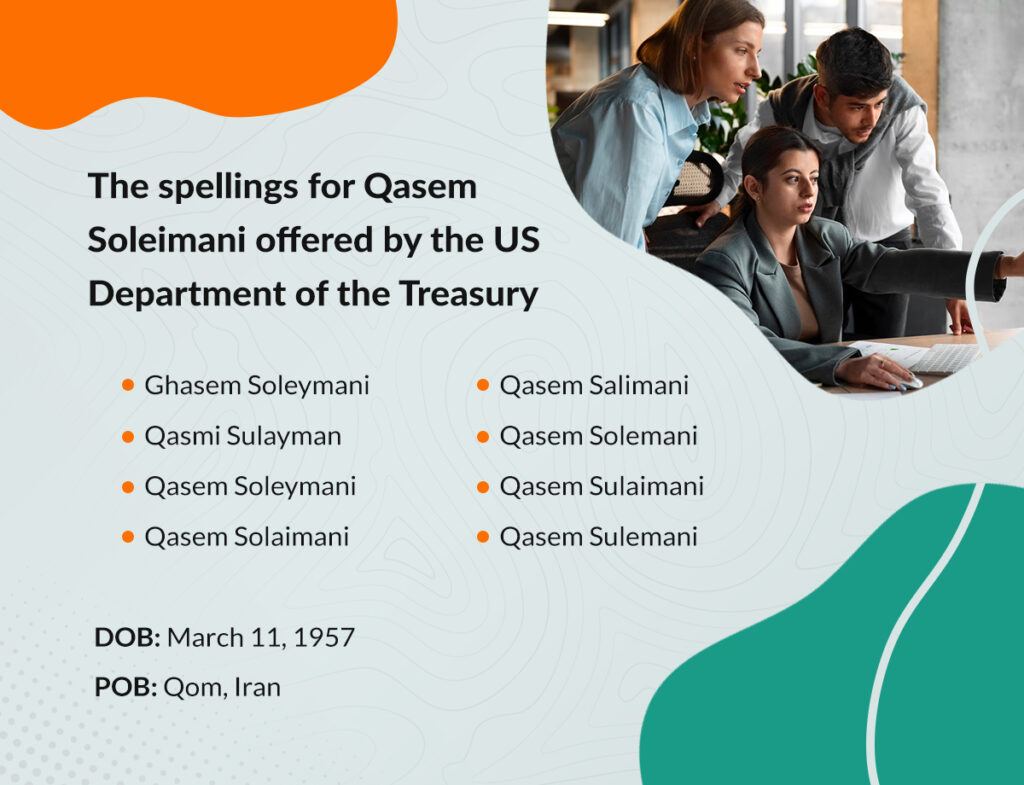

- Segmentation Variants: A single Arabic name can be segmented differently, leading to variants like ” Ghasem Soleymani,” ” Qasmi Sulayman,” or ” Qasem Salimani,” all referring to the same name.

- Transliteration Discrepancies: Different languages employ distinct rules for transliterating Arabic letters. For instance, English transliterates “ش” as “sh,” while French opts for “ch.” The challenge arises when English documents containing French transliterations intersect, resulting in multiple name variations.

Beyond Transliteration: AML Screening Complexities

Transliteration challenges extend beyond merely matching names in Latin characters. AML screening entails even greater complexities:

- Diverse Naming Conventions: Arabic naming conventions aren’t universally standardized. Varying cultural influences and historical practices contribute to a rich tapestry of naming styles.

- Cultural Diversity: Arabic culture has transcended geographical boundaries, leading to diverse naming traditions across different regions.

- Religious Variability: Arabic names aren’t exclusively linked to Islam; they span various religions, including Arab Christians.

- Traditional Naming Conventions: Some individuals adhere to deeply traditional naming conventions, which may contrast with contemporary culture.

Navigating this linguistic landscape requires not only precise transliteration but also a deep understanding of the cultural nuances surrounding Arabic names. For AML screening providers, it’s a multifaceted journey through the diverse world of script, sound, and meaning in the MENA region.

The Importance of Arabic Name Screening

The significance of understanding Arabic names cannot be overstated. The Middle East is a region where the diversity and intricacies of names pose a unique challenge. Effective screening requires not only a grasp of the complexities of Arabic names but also an appreciation of their paramount importance.

Imagine this scenario: Middle Eastern banks maintain databases replete with names written in Arabic script. Regulated entities, private institutions, and regulatory bodies across the globe, including OFAC (Office of Foreign Assets Control), the UAE Local Terrorist list, the EU Consolidated list, Iraq AML & CFT Office Individuals and Entities, UNSC Consolidated list, and many others, publish lists that feature names in Arabic script, often in advanced formats.

It’s a testament to the global nature of finance and the need for precise AML screening.

Arabic names encompass various components, each laden with significance: the Ism (forename), Kunya (paedonymic), Laqab (surname), Nasab (patronymic), and Nisbah (geographical or clan indicator). Notably, not all Arabic names follow fixed conventions, and Arabic culture transcends geographical and religious boundaries, further complicating the landscape.

To illustrate the challenge, let’s consider “Ali Saed bin Ali al-Houri.” This name comprises the Ism, Nasab, and Nisbah, with each element holding a specific meaning and cultural resonance. Similarly, “abu Hamza al-Masri” combines the Kunya and Nisbah, with “Masri” signifying Egyptian heritage.

Understanding Arabic names is not just a matter of linguistic curiosity; it’s the key to precise AML screening. It enables financial institutions, regulatory bodies, and businesses to differentiate between individuals, eliminate false positives, and adhere to stringent AML regulations with cultural sensitivity. It’s a critical facet of the global effort to combat financial crime and uphold the integrity of the financial system.

KYC2020’s Enhanced Arabic Language Screening

With an increasing number of customers in the Middle East, KYC2020 is committed to meeting the unique challenges posed by the Arabic language. In a region where precision in Anti-Money Laundering AML and counter-terrorism financing CTF screening is of utmost importance, our product team is rising to the occasion.

KYC2020 has responded with an advanced screening engine featuring a customized scoring system for Arabic names. This enhancement excels at detecting diacritics within Arabic script, elevating precision in name matching and identification of unique name parts. It’s a solution designed specifically for demanding lists, including the advanced formats of OFAC’s Specially Designated Nationals list, UAE Local Terrorist list, EU Consolidated list, Iraq AML & CFT Office Individuals and Entities, UNSC Consolidated list, private blacklists uploaded by users and more.

The Arabic language varies across regions and cultures. Latin and Arabic scripts are distinctly different, demanding a customized approach. KYC2020’s scoring engine is meticulously designed to account for these regional nuances. It’s fueled by cutting-edge Natural Language Processing (NLP) techniques and doesn’t just normalize names; it optimizes them. This includes removing diacritics, eliminating unnecessary elements, and enhancing accuracy.

We employ a range of advanced techniques to ensure the accuracy and reliability of our Arabic language screening. This includes a meticulous normalization process that addresses specific intricacies of the Arabic script. Our normalization procedures encompass:

- Normalization of Hamza with Alef Seat to a Bare Alef: In Arabic script, the Hamza with Alef Seat is a unique character. We normalize this character to a plain Alef to ensure consistent and accurate matching.

- Normalization of Teh Marbuta to Heh: Arabic script features the Teh Marbuta, a character representing a specific form of the letter Heh. We normalize Teh Marbuta to Heh to ensure uniformity in our database.

- Normalization of Dotless Yeh (Alef Maksura) to Yeh: The Dotless Yeh, also known as Alef Maksura, is another distinct character in Arabic. We normalize this character to Yeh to facilitate accurate matching and recognition.

- Removal of Arabic Diacritics (the Harakat): Arabic diacritics, known as Harakat, are marks that indicate vowel sounds and pronunciation. Removing these diacritics helps streamline the screening process and enhance matching precision.

- Removal of Tatweel (Stretching Character): Tatweel is a character used to elongate certain letters in Arabic script. We remove this character to avoid discrepancies in matching due to variations in character length.

By implementing these normalization techniques, we ensure that Arabic names are accurately represented and matched within our screening engine. This meticulous approach minimizes the chances of false positives or missed matches, contributing to the overall effectiveness of our AML screening solution.

Our customized scoring engine comprehensively addresses phonetic similarities, spelling variations, titles, and honorifics, as well as issues like missing spaces and hyphens, nicknames, and out-of-order components. In essence, it’s a holistic solution that leaves no room for error.

Transliteration between Arabic and Latin scripts is a minefield of potential errors. KYC2020’s engine tackles this using linguistic, orthographic, and phonological algorithms, it minimizes transliteration errors, ensuring that no true positive goes unnoticed. Beyond that, it’s adept at mitigating common errors that often lead to missed matches, such as misspellings, phonetic misunderstandings, and nicknames.

Our commitment to comprehensive screening extends beyond the Arabic language. We’ve obliterated language barriers, regardless of the script. Names in Arabic script or any other non-Roman script are seamlessly processed. Here’s how it works: we translate and transliterate names into Roman characters, normalize them, and integrate them into our persona database. This advanced feature not only facilitates precise searches in the original script but also enables fuzzy searches on Roman name inputs, guaranteeing comprehensive and accurate results across diverse linguistic inputs.