In today’s rapidly growing global economy, payment providers (PSPs) face a daunting challenge – navigating the web of payment regulations while maintaining strict Anti-Money Laundering (AML) and Know Your Customer (KYC) standards. Compliance isn’t merely a best practice; it’s the bedrock upon which a sustainable payment ecosystem is built. These regulations encompass a broad spectrum of payment services and are indispensable for PSPs looking to steer clear of substantial fines, legal entanglements, and potential damage to their reputation.

Understanding Payment Service Regulations: Payment service regulations are a collection of guidelines meticulously crafted to ensure that PSPs carry out robust due diligence, effectively mitigating the risks associated with financial fraud. These regulations can vary significantly across different jurisdictions, adapting to the ever-evolving landscape of payment processing. Navigating this regulatory maze demands a strategic approach to compliance.

Regulatory Landscapes Across Jurisdictions:

European Union (EU): The Second Payment Services Directive (PSD2) underscores the regulatory landscape for electronic payment services in the EU. Emphasizing strong customer authentication (SCA) and open banking, PSD2 promotes innovation while enhancing security and consumer choice.

United Kingdom (UK): The Payment Services Regulations 2017 (PSRs 2017) serves as the key legislation governing payment services in the UK. It extends the scope of payment services regulations and introduces changes that improve consumer protection, communication, and fraud prevention.

United States (US): Payment service regulations in the US are governed by multiple state and federal regulators, leading to a complex web of compliance requirements. The emergence of regulations related to digital assets and FinTechs is anticipated in the near future.

Singapore: Regulated by the Monetary Authority of Singapore (MAS), the Payment Services Act (PSA) aims to create an innovative environment for FinTechs. It combines previous acts to establish a comprehensive framework for new and traditional licensable payment activities.

India: Navigating the Regulatory Landscape: India, a burgeoning hub for FinTech innovation and digital payments, has established a robust regulatory framework to ensure the integrity and security of payment services. The Reserve Bank of India (RBI) plays a pivotal role in overseeing and guiding payment processors and aggregators to maintain compliance and uphold consumer protection.

Guidelines for Payment Aggregators and Payment Gateways: In March 2020, the RBI introduced the “Guidelines on Regulation of Payment Aggregators and Payment Gateways,” a comprehensive regulatory framework to govern the operations of payment aggregators and gateways in India. These guidelines are designed to foster transparency, customer security, and effective risk management within the payment processing ecosystem.

Key Features of the Guidelines:

- Registration and Eligibility Criteria: The guidelines mandate that all non-bank payment aggregators must obtain registration from the RBI. These entities are required to be incorporated as companies under the Companies Act, 1956/2013. Additionally, the guidelines set out minimum net-worth requirements for both new and existing payment aggregators.

- Background Checks and Due Diligence: Payment aggregators are now responsible for conducting comprehensive due diligence and background checks on merchants. This measure ensures that merchants adhere to ethical business practices and do not engage in the sale of counterfeit or fraudulent products.

- Governance and Oversight: To ensure sound governance, the guidelines emphasize that payment aggregators must satisfy the “fit and proper” criteria established by the RBI. Additionally, these entities are required to communicate any changes in control or takeover to the RBI.

- Anti-Money Laundering (AML) Compliance: Payment aggregators are obligated to adhere to the RBI’s “Know Your Customer” (KYC) directions, along with AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) requirements. This includes verifying customers’ identities, maintaining KYC records, and monitoring transactions for suspicious activities.

- Settlement and Escrow Accounts: Payment aggregators are required to maintain an escrow account with a scheduled commercial bank to facilitate secure fund settlements. The guidelines prescribe the permissible debit and credit transactions that can be executed through this account.

- Technology and Security Standards: The RBI places significant importance on data security and cybersecurity. Payment aggregators are expected to adhere to baseline technology and encryption standards, conduct regular system audits, and implement mechanisms to handle cybersecurity incidents effectively.

- Local Storage of Payment Data: Reflecting the RBI’s data localization mandate, payment aggregators are required to store all payment system data exclusively on servers located within India.

- Consumer Grievance Redressal: The guidelines underscore the importance of effective consumer grievance redressal mechanisms. Payment aggregators are required to establish a framework for addressing customer complaints and concerns promptly.

Conclusion: Empowering Payment Providers with AML/KYC Compliance

India’s regulatory framework for payment processors and aggregators reflects a forward-looking approach that prioritizes consumer protection, data security, and ethical business practices. The RBI’s guidelines empower payment processors to conduct due diligence, enhance risk management, and ensure compliance with AML/CFT norms. As India’s digital payments landscape continues to evolve, payment processors that embrace these regulations position themselves as responsible and trusted partners in the growth of the FinTech ecosystem.

KYC2020’s Merchant Screening Technology: Streamlining AML/KYC Compliance

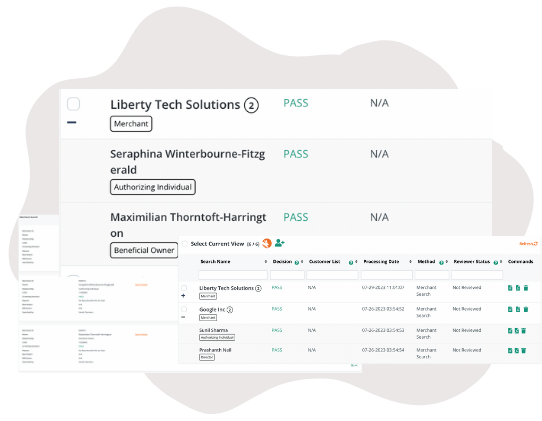

Within the landscape of payment processor onboarding, KYC2020’s merchant screening technology emerges as a cutting-edge solution, revolutionizing the due diligence process. Our latest release of DecisionIQ is designed with Payment Providers in mind, offering a suite of features to facilitate seamless AML/KYC compliance.

Efficiency through Streamlined Searchability: DecisionIQ enables Payments companies to streamline searchability for businesses and beneficial owners. With the ability to group multiple names under a single ID, the process becomes seamless and efficient. Payment Providers can now effortlessly manage and verify merchant information, ensuring compliance without compromising on speed or accuracy. Welcome your merchants with ease and confidence, knowing that our platform has got you covered every step of the way.

Data Security at the Core: At KYC2020, we take data security seriously. Our ISO27001 certification for information security guarantees that your sensitive data is handled with the utmost care and protection. Moreover, we’ve designed our solution to be GDPR ready, ensuring that your data protection obligations are met with the highest standards. Your peace of mind regarding data security is our priority.

Seamless Integration: We understand that speed is essential for Payment Providers. With our seamless integration capabilities, you can effortlessly integrate our API with your existing systems. This automation simplifies onboarding processes and enhances workflows, making compliance tasks efficient and streamlined. Payment Providers can focus on their core operations while relying on our platform for robust AML/KYC compliance.

Audit-Trail Transparency: KYC2020 offers full audit trail transparency, recording every step of compliance processes in real-time. With detailed logs and timestamps, our solution empowers businesses to demonstrate due diligence, ensure AML/KYC compliance, and easily identify and address potential issues. Trust our platform to enhance your compliance posture and build confidence with regulators and customers alike.

Stay Fully FATF Compliant: As a payment provider, adhering to Financial Action Task Force (FATF) guidelines is crucial. KYC2020’s DecisionIQ ensures robust AML screening, sanction checks, and PEP identification, enabling you to meet FATF’s stringent requirements. Our AI-powered platform empowers your payment processes with real-time data coverage and risk-based monitoring, ensuring airtight compliance and bolstering your reputation.

In conclusion, KYC2020 stands as your trusted ally in navigating the complex regulatory landscape of payment processing. We provide the tools, technology, and expertise you need to ensure compliance, protect your reputation, and continue to drive innovation in the world of payments.