What unique challenges are credit unions facing in their AML compliance heading into 2021? This is the second article of our three-part series on AML compliance among today’s credit unions. Anti-money laundering (AML) compliance has always been a significant burden…

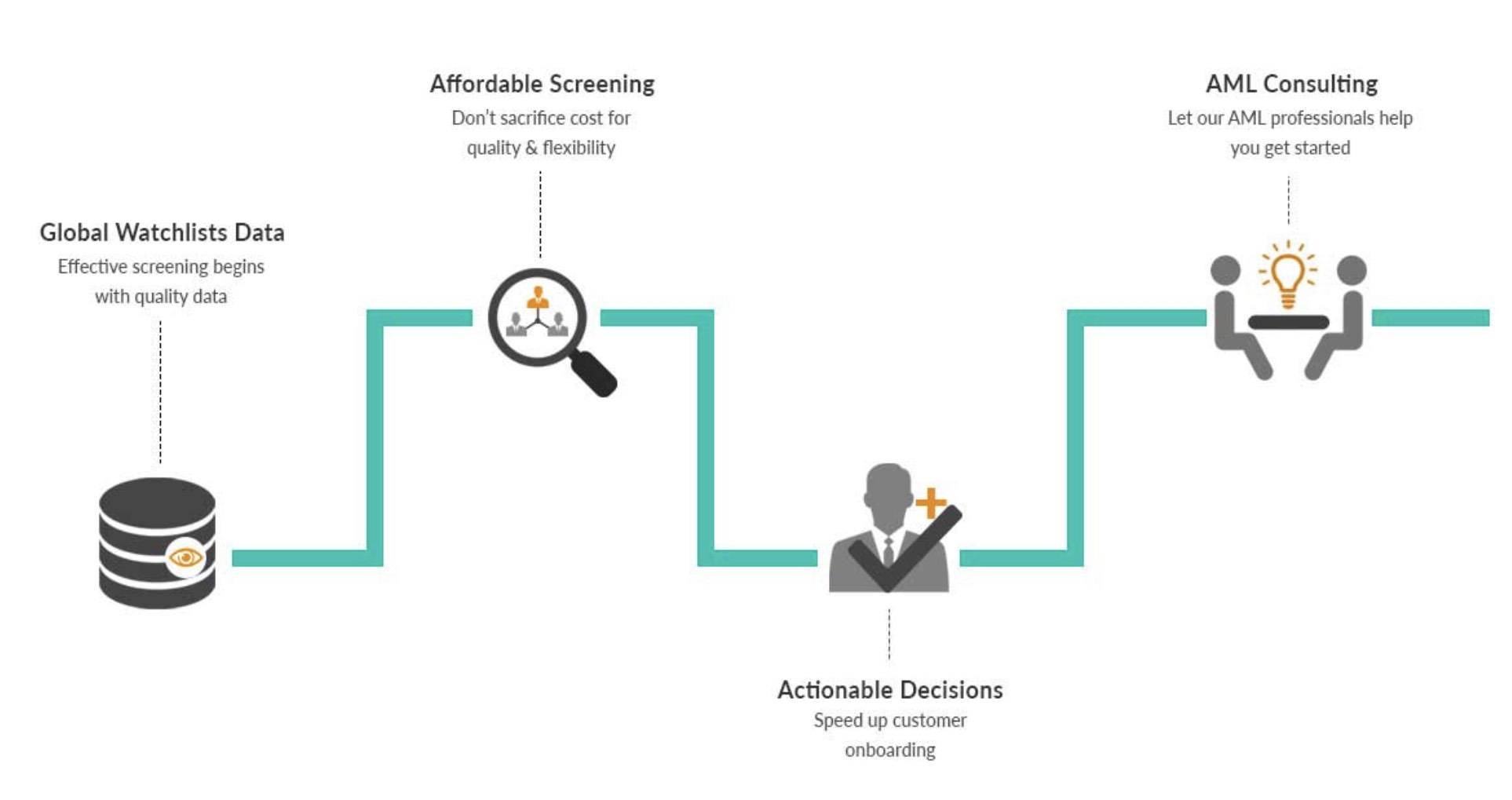

Sanctions Screening

How AI helps your company fight Cyber Crime

Easy access to online payments, including money transfers, makes the need for sanction screening and AML compliance critical. Fines for AML/CFT non-compliance can be significant. For SME’s, credit unions, and Fintech companies, finding efficient and affordable solutions had been out…

Designating the Chief AML Compliance Officer

A classic Fintech startup has a tight budget making it difficult to hire a dedicated Chief AML Compliance Officer (CAMLO). This leads them to designating either a founder or other members in the organization to take on this role as…

The Various AML Compliance Agencies

Navigating the complexities of AML compliance is no easy task. Simply understanding the agencies that create regulations and enforce regulations can be challenging enough. This makes the task of maintaining AML compliance even more challenging especially when it comes to…

Introducing Our Free AML Risk Assessment Tool

Any business that deals in money and financial assets should start with a Risk Assessment for Money Laundering, Human Trafficking, and Terrorism funding. This includes firms that deal in cryptocurrency, payments, remittances, real estate, and other high-value commodities. AML Risk…

The Newcomer’s Guide to Tools to Fight Money Laundering

`After researching for a while when I first came to the KYC2020 team, I realized that money laundering was a hugely complicated problem for countries and financial systems. I discovered that anti-money laundering compliance and vigilance is more of a…

The Newcomer’s Guide to The Essential Features of a Robust AML Compliance Program

In my research to better integrate into the KYC2020 team, I discovered that having an anti-money laundering program in place is a pre-requisite for all organizations these days. Money laundering has serious consequences attached to it and failing to implement…

The Newcomer’s Guide to The Consequences of Non-Compliance

I’ve been writing this Newcomer’s Guide to the AML Galaxy for a while now and I’ve written a line over and over again, “Failure to comply with AML regulations has serious consequences.” But I’ve never gotten into any specifics. Yes,…

The Newcomer’s Guide to Protecting Your Small Business from Money Laundering

When I was hired on to help KYC2020 with their marketing strategy, I was completely new to the concept of AML complaince solutions. I never thought seriously about the threat of money laundering. Nor had I thought about what steps…

Introducing Our Free Watchlist Builder

New payment innovators, FinTech, Virtual Currency exchanges, and MSBs face the challenge of not knowing which sanction lists they should be screening for AML compliance. Their compliance programs often lack a risk-based approach to sanction screening, resulting in tremendous cost…