For more than 30 years, the Financial Action Task Force (FATF) has been the global standard by which many countries have wholeheartedly adopted the measure to combat Money Laundering and Terrorist Financing(ML/TF). Since the FATF first started in the late…

Blog

Building AML Compliance in Today’s Credit Unions

As regulators increase AML compliance demands on credit unions, the high cost of AML compliance is a critical challenge. How can credit unions both fulfill AML requirements and improve operations? Over the past few years complying with anti-money laundering (AML)…

5 Key Aspects to Finding the Right CAMLO

As a reporting entity under most Anti-Money Laundering and Counter-Terrorist Financing (AML/CTF) regulations you must appoint an able and qualified person as your Chief Anti-Money Laundering Officer (CAMLO). This is essentially the first step to meeting your legal obligations. The…

Writing Your AML Policy for Fintech Startups

Financial technology (Fintech) firms are subject to Anti-Money Laundering (AML) regulations or oversight via their relationship and dependency on banks. The unassuming, but crucial expectation, of this oversight is an AML policy which describes how the Fintech will administer their…

Designating the Chief AML Compliance Officer

A classic Fintech startup has a tight budget making it difficult to hire a dedicated Chief AML Compliance Officer (CAMLO). This leads them to designating either a founder or other members in the organization to take on this role as…

The Various AML Compliance Agencies

Navigating the complexities of AML compliance is no easy task. Simply understanding the agencies that create regulations and enforce regulations can be challenging enough. This makes the task of maintaining AML compliance even more challenging especially when it comes to…

The Real Costs of AML Compliance

In 2018, LexisNexis found that the total costs of AML Compliance for financial firms in the United States is approximately $25.3 billion per year of operation. Compared to a firm’s bottom line, small businesses pay the most at upwards of…

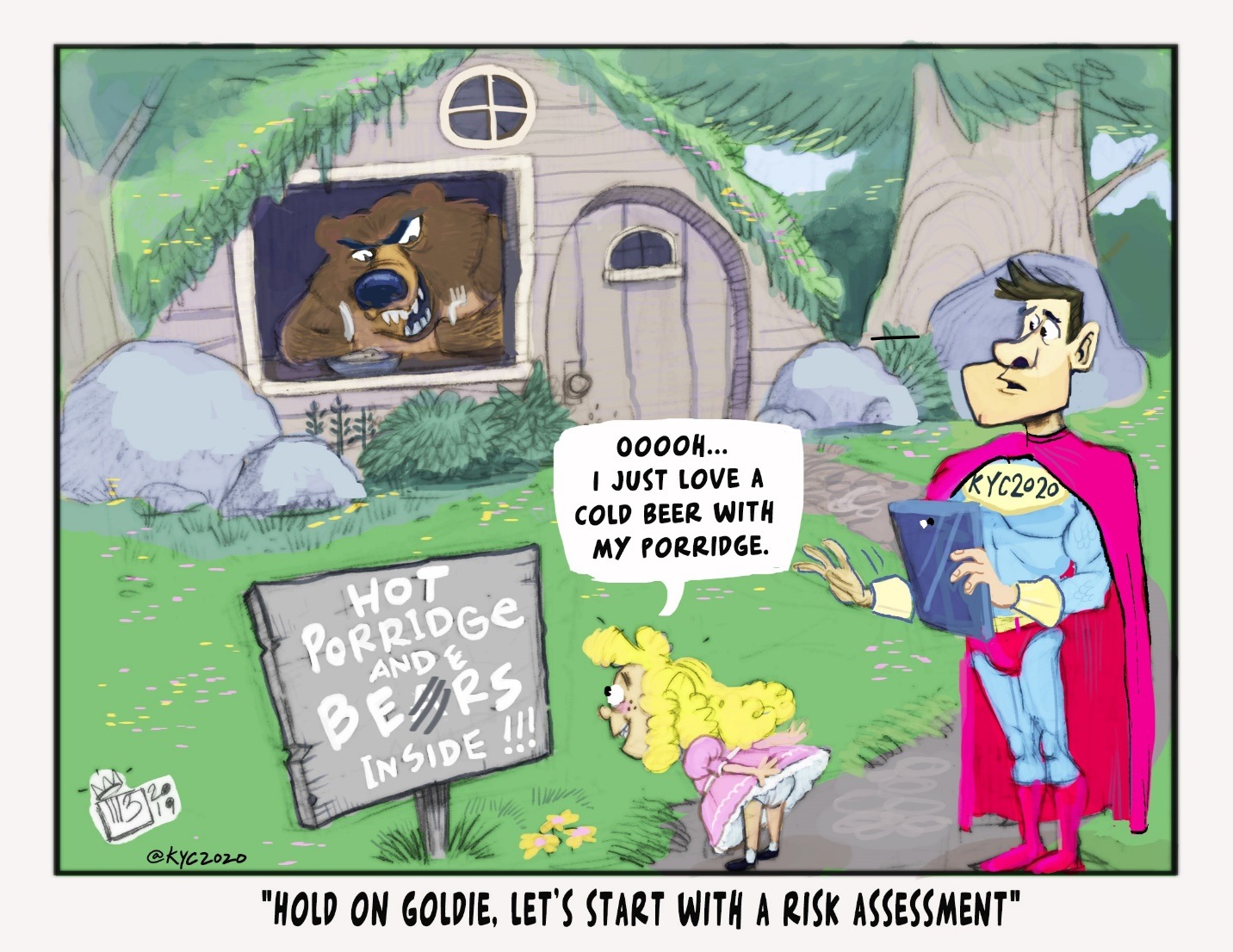

Introducing Our Free AML Risk Assessment Tool

Any business that deals in money and financial assets should start with a Risk Assessment for Money Laundering, Human Trafficking, and Terrorism funding. This includes firms that deal in cryptocurrency, payments, remittances, real estate, and other high-value commodities. AML Risk…

AML Risk Assessments are an Eye Opener

As part of any AML compliance regime, the first step is to do an assessment of the risk associated with the business according to regulatory requirements. The Risk Assessment, or RA, takes into account a large scope of the business…

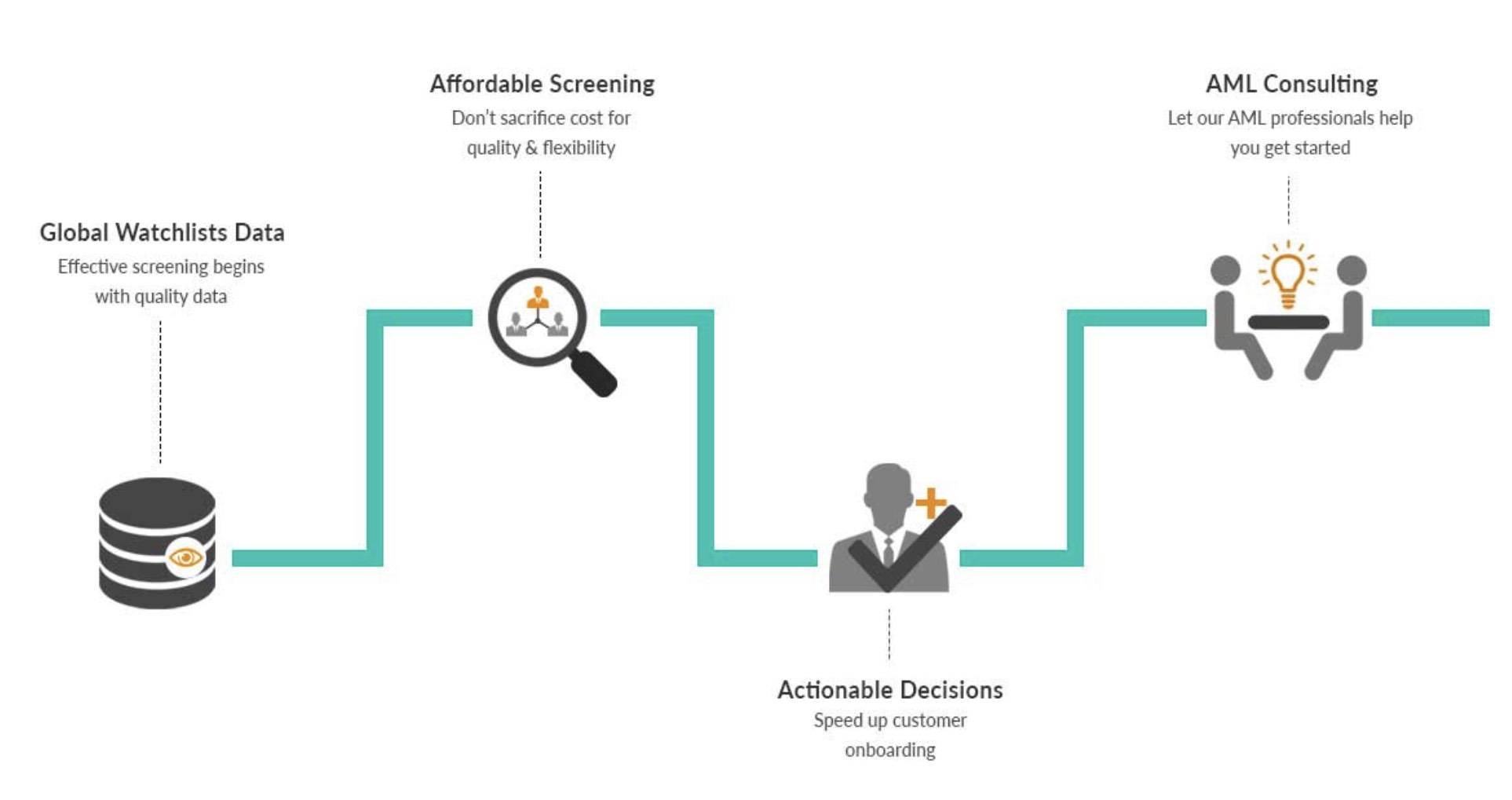

The Newcomer’s Guide to Tools to Fight Money Laundering

`After researching for a while when I first came to the KYC2020 team, I realized that money laundering was a hugely complicated problem for countries and financial systems. I discovered that anti-money laundering compliance and vigilance is more of a…