THE CHALLENGE

FINCEN lists several factors to consider when categorizing an entity as a high risk business (HRB). These include MSBs, Casinos, and Online Gaming. These HRBs must be identified for Enhanced Due Diligence and regularly monitored per a risk-based approach for AML Compliance.

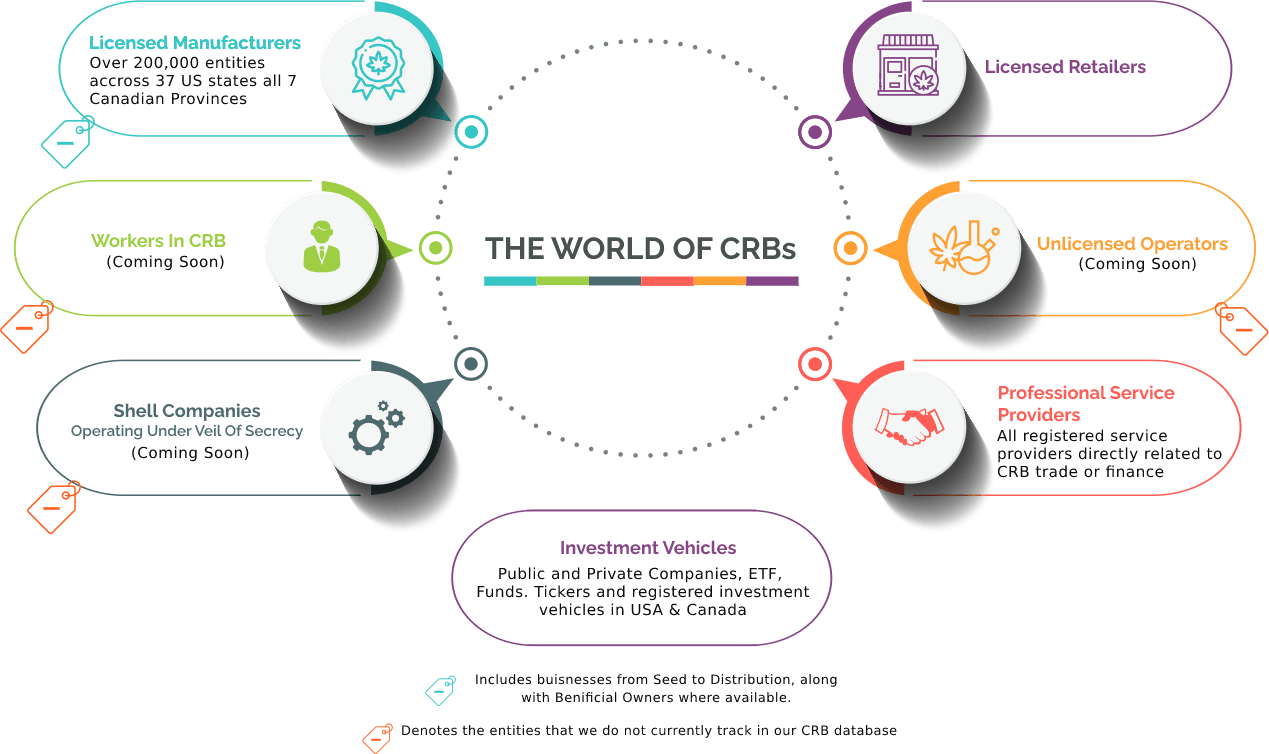

When banking or deciding to not bank a certain category of HRBs, a Bank or Credit Union must consider additional factors that pose risk to the institution. This includes everything from the regulated nature of the business, the activity conducted, to the customers they serve. For example, in the case of USA, Cannabis Related Businesses (CRBs) pose an extraordinary level of risk to the financial institution because they not only fit the FINCEN definitions for high risk, but because (a) are highly regulated businesses from seed-to-distribution, (b) are still a prohibited activity at the Federal level, and c) are services that have plenty of social controversy, questionability, carry reputation risk.

The biggest risk to a Bank or Credit Union is not correctly identifying businesses that are HRBs, or beneficial owners of HRBs. This can lead to either banking a business that the financial institution publicly claims to not deal with as a matter of policy, or applying incorrect monitoring and risk controls on the high risk business. The harm to the institution as a result can be material.

THE SOLUTION

HRB Check® screens specific lists within VisionIQ watchlist database to clearly identify MSBs, CRBs, Casinos, and Online Gaming. The data sources include Regulated Authority watchlists for illegal Money Service Businesses, public lists for registered casinos and online gaming businesses, state and provincial licensing data in USA and Canada for CRBs, and our Adverse Media database for persons and businesses with negative news associations to a high risk business or activity.

HRB Check is enabled as part of SmartScan for traditional screening, or as part of DecisionIQ to get AI-based actionable pass/fail screening decisions.