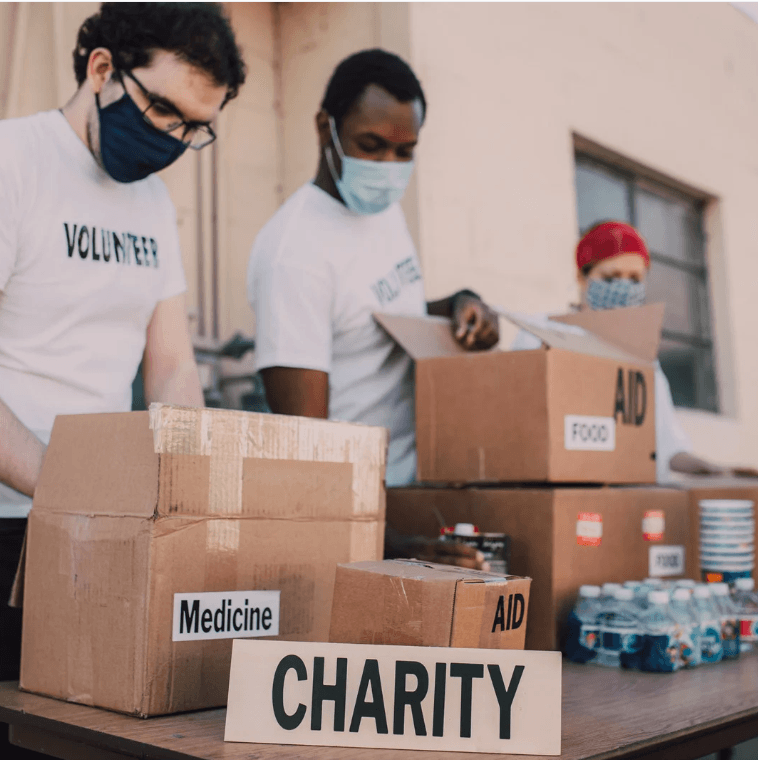

Free Sanctions Program

Qualifying Charities, Journalists, Researchers and non-profits now have FREE access to best-in-class Global Sanction, PEP & Negative News screening to help fight financial crime.

Challenges with low cost or free unsupported open sanctions solutions

Lack of comprehensive quality data, ineffective screening capabilities and data privacy controls

High-friction and manually intensive with lack of case management

Potential legal and reputational risks for the NPO or loss of banking services

What is the free sanctions program?

What is the free sanctions program?

KYC2020 selected as one of the

KYC2020 selected as one of the

While people were racing to build

While people were racing to build

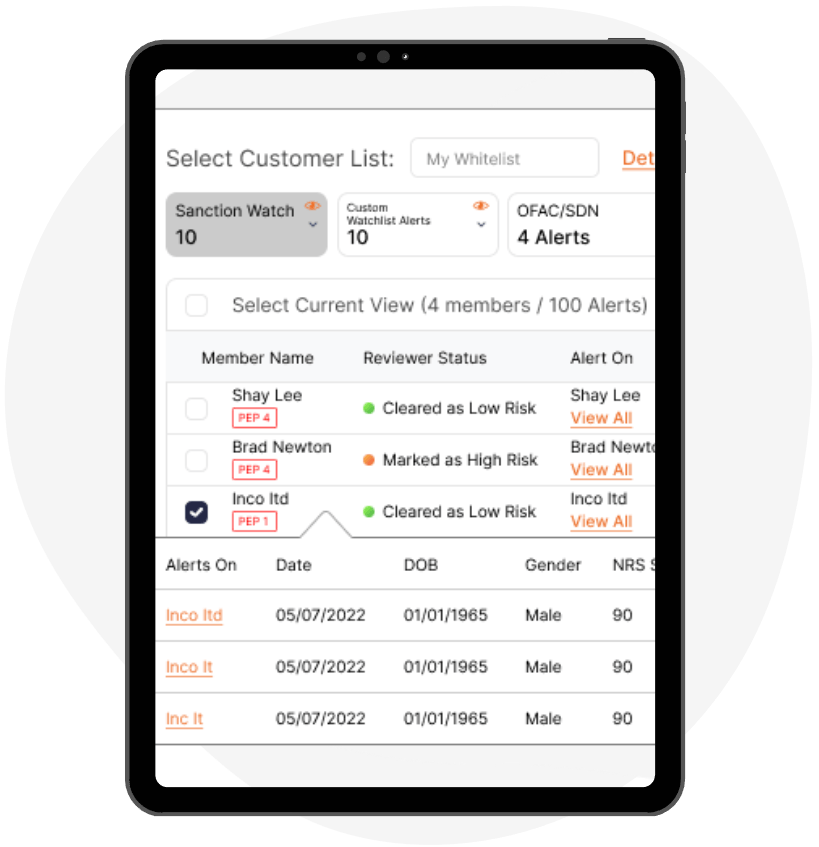

New capabilities help speed up

New capabilities help speed up