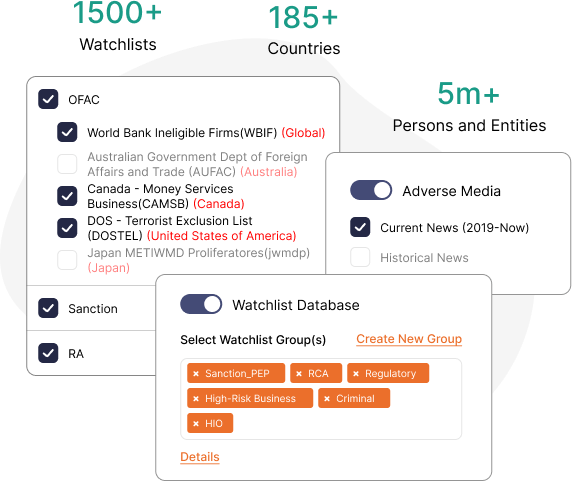

ROBUST SANCTION, PEP & ADVERSE MEDIA SCREENING

AML Compliance does not have to be so

costly and disruptive. Our prices can't be beat!

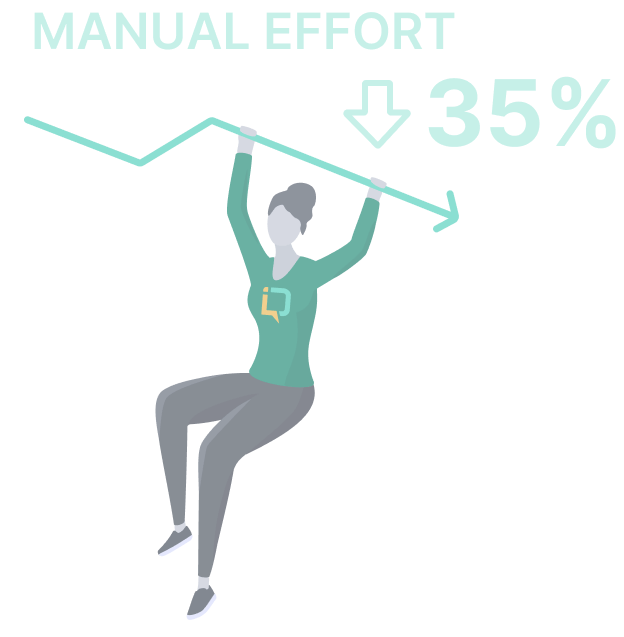

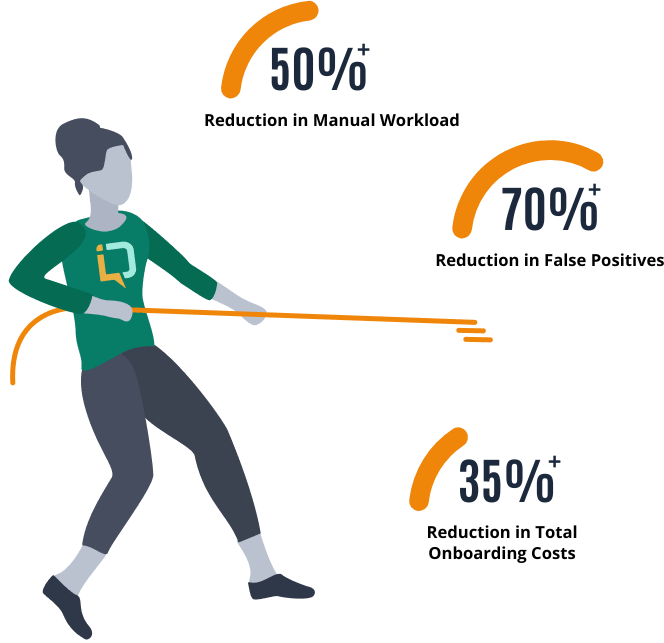

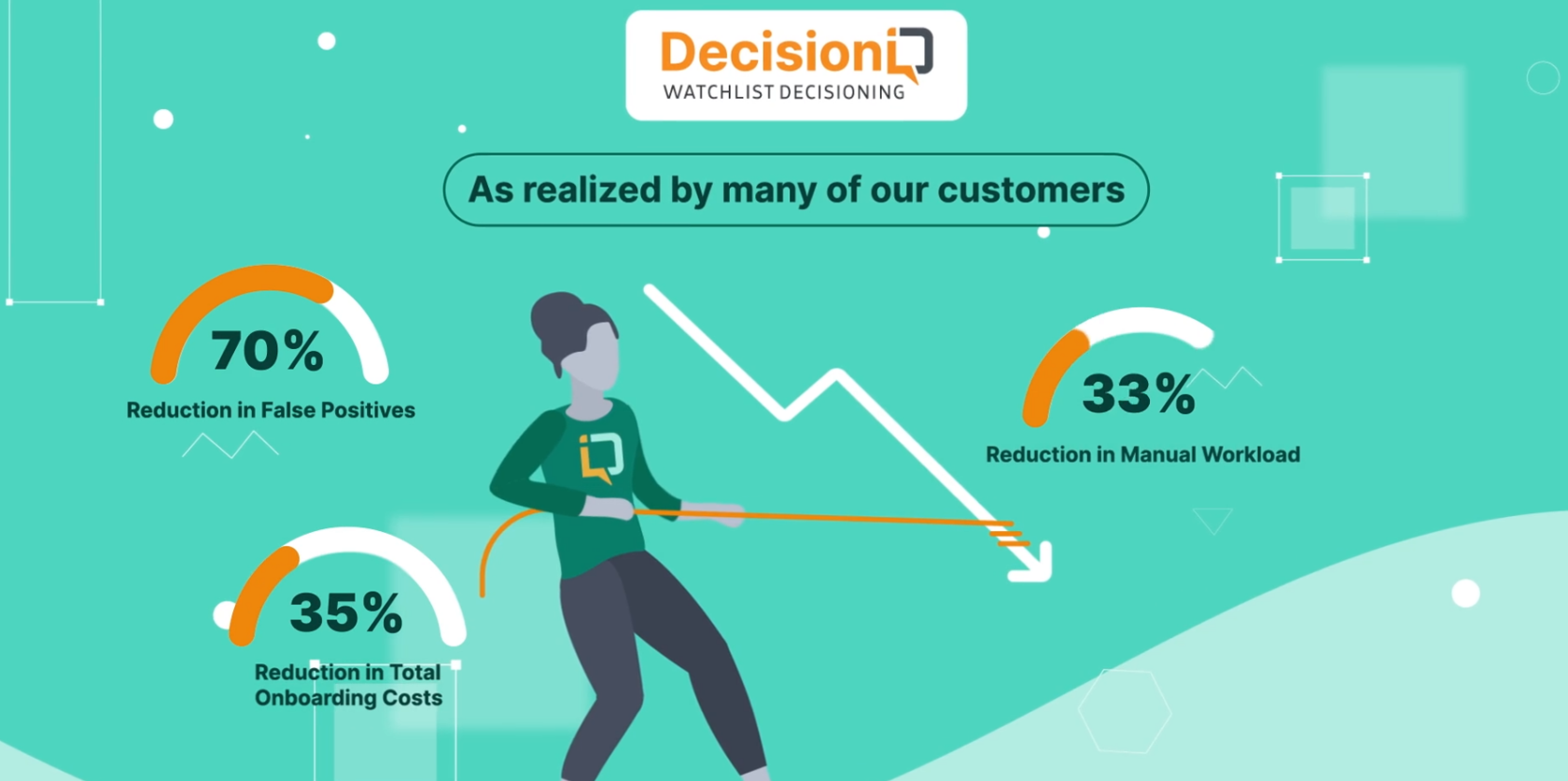

OVER 35% REDUCTION IN MANUAL EFFORT AND OVER 95% LOWER FALSE POSITIVES

Find out how CoinChange reduced the overall cost of Watchlist Screening while accelerating client onboarding.

KYC2020 IS A GLOBALLY RECOGNIZED REGTECH COMPANY

We make AML Compliance easy, effective,

and affordable.You have our guarantee!

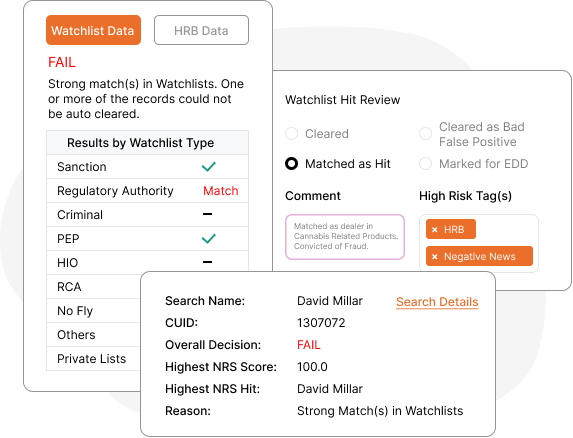

CONSIDERING BANKING CANNABIS RELATED BUSINESSES?

Correctly identify high risk businesses as part of your AML screening. We've got you covered!

AML COMPLIANCE WEIGHING YOU DOWN ?

Talk to us about Risk Assessment, AML Regimes,

Consulting, and more. We do more than just Screening!

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

KYC2020 selected as one of the world’s most innovative companies developing AI technologies in Financial Services

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

While people were racing to build FinTech companies, the founders of KYC2020 saw this as a rising opportunity for a RegTech solution.

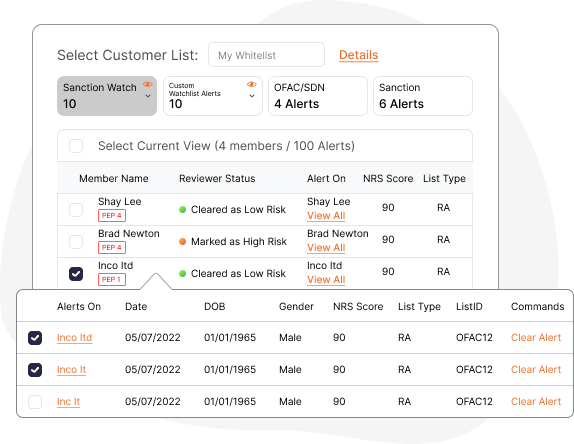

New capabilities help speed up client onboarding and reduce overall costs of AML compliance

New capabilities help speed up client onboarding and reduce overall costs of AML compliance